Last week GRAFT blockchain celebrated its 1st big birthday! We started this journey together one year ago when we launched the Mainnet and 1 year later (although it feels like 20 in blockchain years 🙂 ) we look back on it with feelings representing a spectrum from incredible pride and joy from what we’ve been able to accomplish to a bit of stress and frustration at times due to various attacks and hiccups along the way.

First, the Good

We have worked super hard for the entire year to deliver the base of GRAFT Blockchain Protocol and GRAFT Network ecosystem – 10’s of thousands lines of code, 100’s of architecture and status meetings and decisions, refactoring, optimizations, diagnostics, bug fixing, learning from other projects and science papers, and from the community.

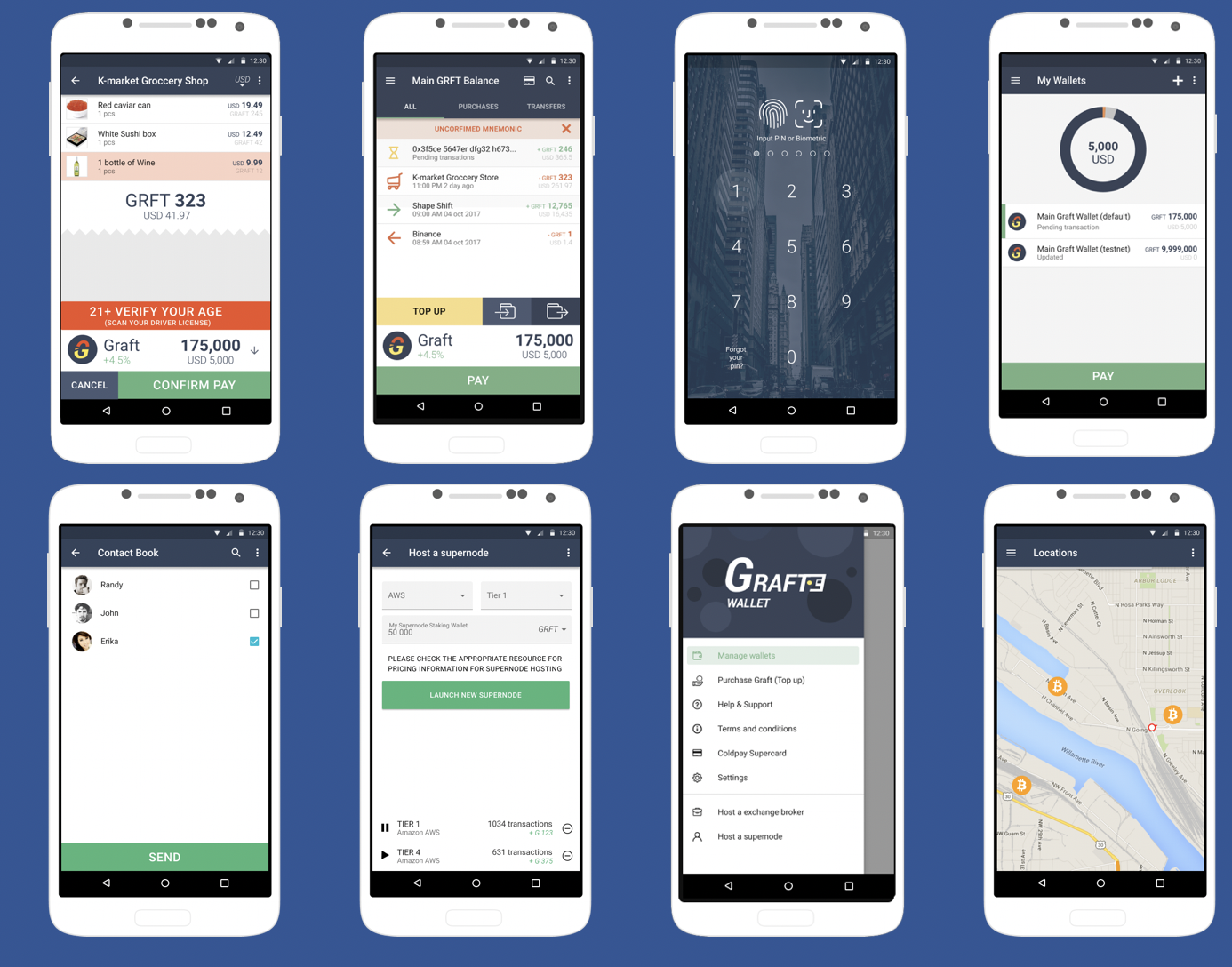

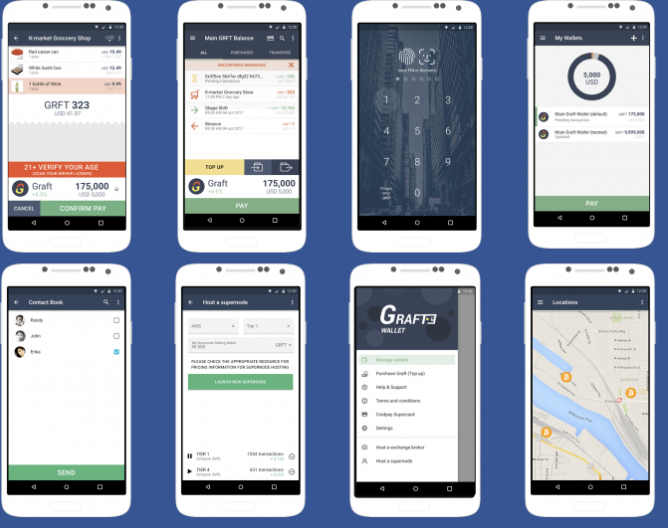

We will let the results speak for themselves – we were able to deliver on all critical parts of the project and then some:

We are very proud of what we’ve been able to accomplish so far – it was no small feat!

The Hiccups

Did we learn a lot in that past year though! Coming into the project with lots of enterprise and startup product design and software development experience, with solid understanding of the math, principles, and techniques of the blockchain and business of payments, but with little practical experience in bringing up a new blockchain, and with limited experience running an open source project, we were in for a very steep learning curve getting up to speed and learning the ropes of this new frontier.

First, we want to own up to the mistakes that we’ve made and the improvements we can make:

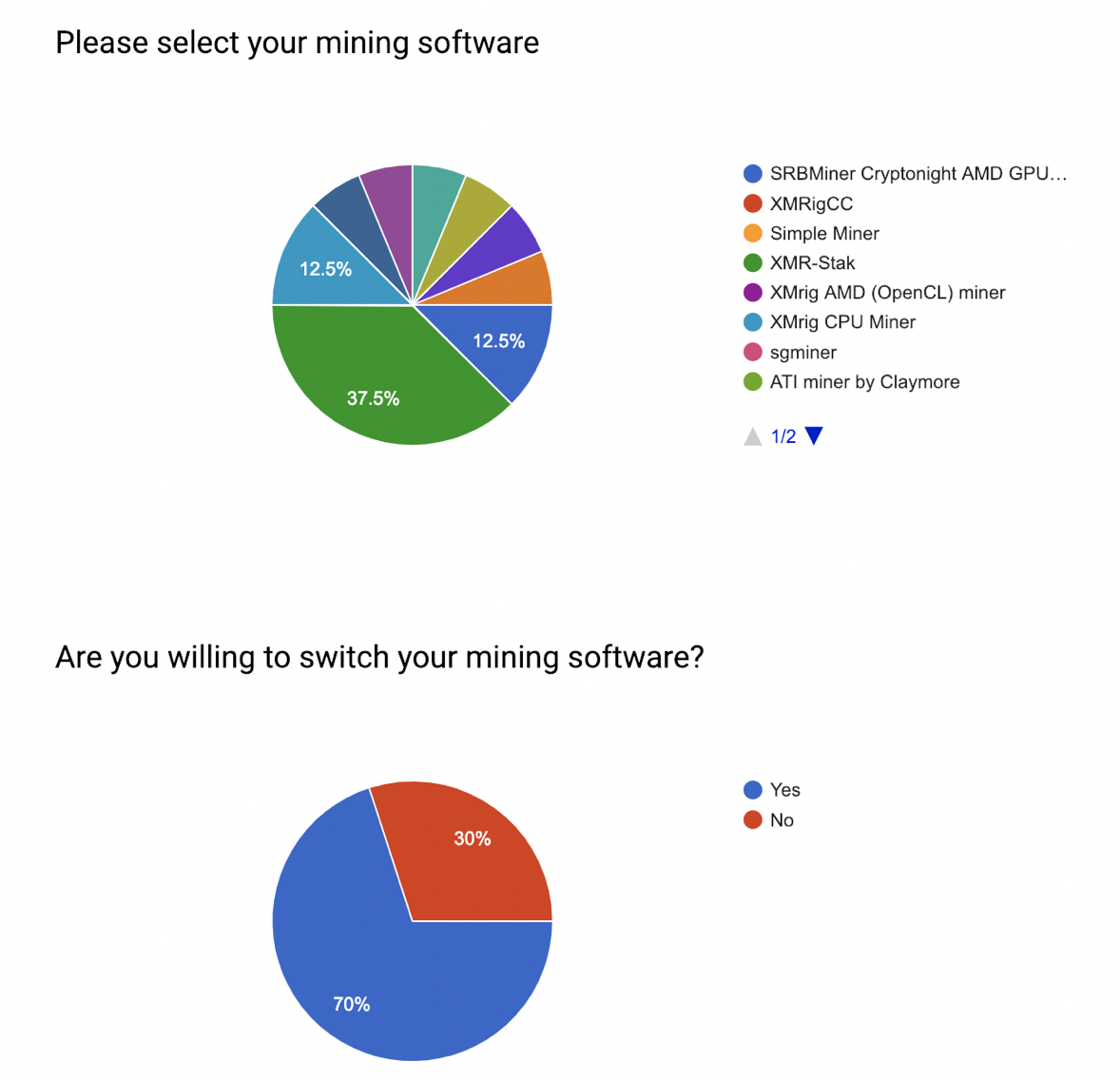

1. We should have factored in the cost of mining as a factor for the ICO token price determination. It was difficult to forecast due to the fact that we didn’t know how many miners were going to step in and what the resulting hash rate was going to be, but we should have done more to model it. We also tried to remedy the situation with an idea of an airdrop if the price doesn’t recover – while we had the best intentions in mind with that, we didn’t think it all the way through and ended up retracting.

2. We should have been more upfront with publishing the RTA flow design to allow for feedback sooner – it would have saved us some redesign work.

3. We didn’t do enough to involve the community at various times in the project and didn’t communicate as much or as often as we should have at times.

4. We recognize that the alternative definition of the word “graft” can become an unnecessary hindrance during the commercial adoption phase and considering opening up a rebranding effort in the near future.

Finally, we want to take this opportunity to offer apologies to anyone we may have offended along the way – we realize people have had different expectations jumping into a project like GRAFT and sometimes expressed their grievances in a way that we couldn’t handle. We meant no disrespect – we are just watching out for the health of the project and for the team morale.

Course Corrections

We are taking steps to align with the vision of the community project by opening up design, development, and moving towards including the community into decision making. We have to strike a careful balance of getting the project up to speed before we “let go of the wheel” completely though. Opening up the project to community decision making is very democratic, but will usually lead to a lot of delays and stalling as various groups or individuals will see different solutions to problems and agreements will take time to emerge. DAO mechanism has to be thought out carefully borrowing from and innovating on top of the best practices.

As evidenced by other open source projects, the best strategy in regards to this dynamic is for the core team to lead the initial ramp in technology and business development and then start sharing the responsibility with the community once the community development and governance are strong enough.

To that end, we have implemented a hybrid development approach with a community tree https://github.com/jagerman/GraftNetwork and have opened up the design for community review.

https://github.com/graft-project/graft-ng/wiki/GRAFT-RFCs,-Proposals-Design,-Papers

Another balancing act that we have to do is balancing the long term and short term goals and approaches. While long term we’re striving for the ultimate in privacy and decentralization, at times we have to make some temporary compromises in order to expedite development, roll-out, or adoption.

What’s Next?

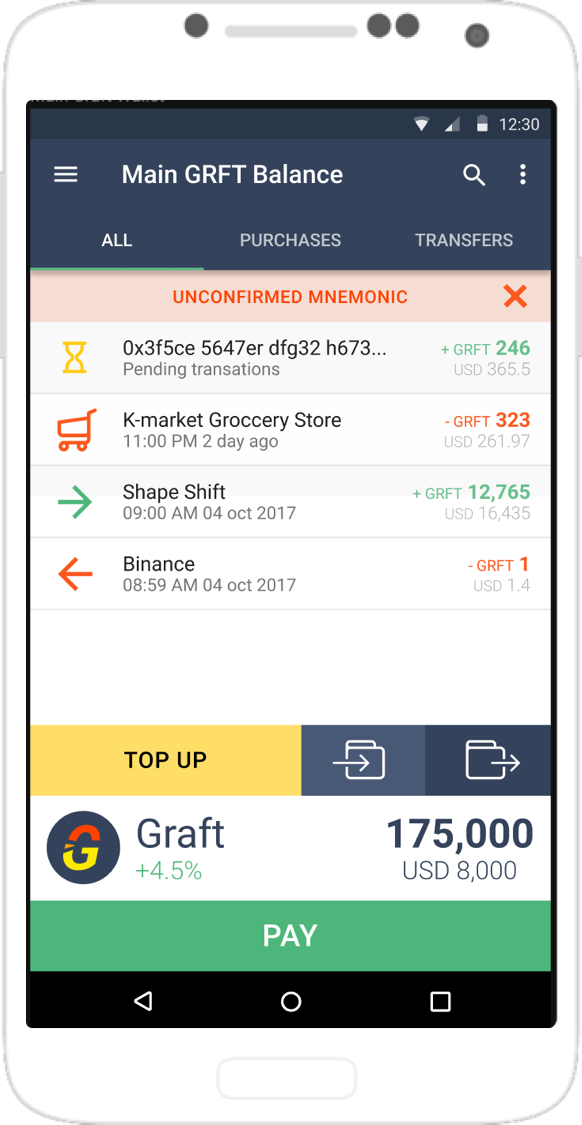

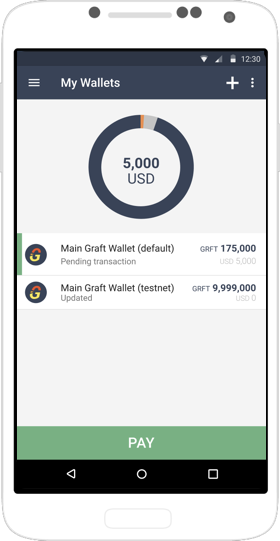

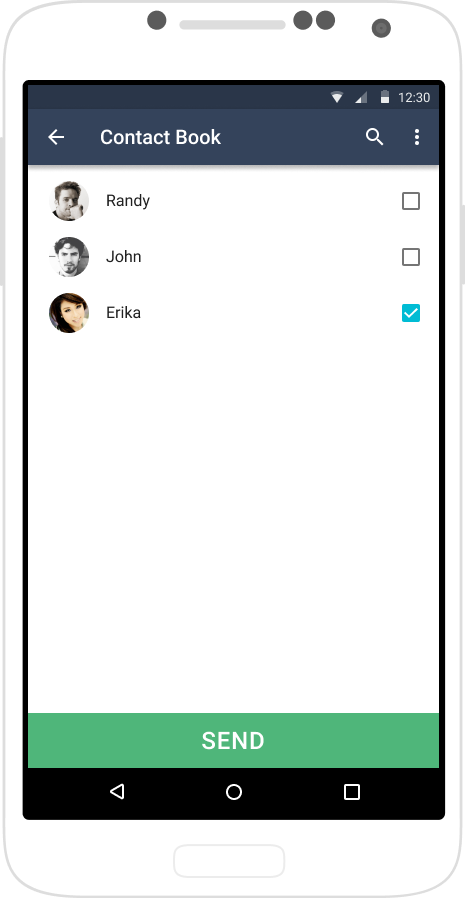

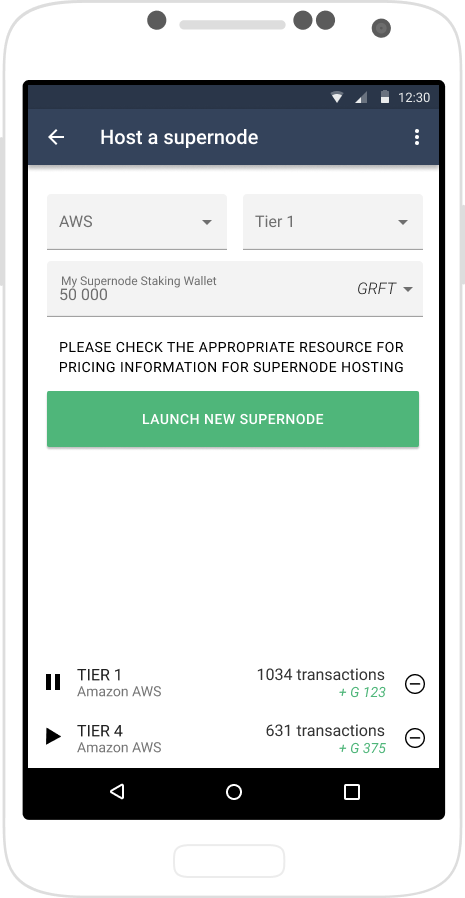

The next phase of the execution is to get ready for the real world adoption, which will include rolling out the RTA supernodes to the mainnet, updating the client (wallet) software, supporting reference software needed for integrations, improving liquidity through larger exchanges, and pursuing various market development efforts via existing channels as well as developing new creative ways to get traction. We’ve got a big year ahead of us!

We are also looking a step ahead from the technology perspective.

All technological solutions must continuously evolve in order to survive, and blockchain and payment systems are not exception. As other forward-thinking projects in the field (e.g. Ethereum), we’re looking at migrating to pure proof-of-stake based model in the future with the following objectives:

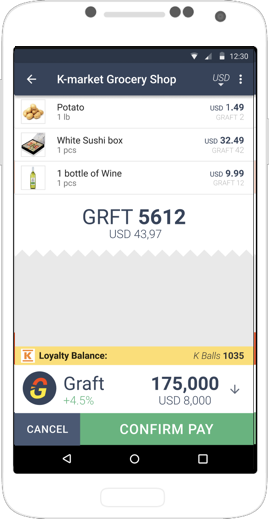

- Retaining GRAFT’s marque privacy, real time authorizations, buyer-friendly fee structure, multi-currency support, special merchant transaction flows, custom merchant tokens, participating economy, and more (see original GRAFT white paper for more details)

- Eliminating Proof of Work altogether*

- Providing virtually unlimited scalability to enable TPS (transactions per second) rates competitive with traditional payment processing networks

- Eliminating a prolonged locking of funds in user wallets (both payer and payee) caused by waiting for multiple “block confirmations”

- Reducing the network latency that affect transaction authorization times to insignificant minimum

- Adding open banking features that would provide financial benefits to all users

The draft version of the new design and some preliminary proof of concept samples will be published for community review.

* When and if we switch to proof of stake blockchain, all the GRFT tokens will be converted and the total supply will always stay the same.

Wrapping Up

We have done a lot over this past year and learned a lot! We’ve built a solid foundation of a network that addresses three of blockchain and cryptocurrencies most promising areas (payments, loyalty programs, and decentralized exchanges).

At this point, we feel like we are on solid footing with the RTA Supernode and the rest of the ecosystem nearing the finish line, with major design issues having been addressed. We have a solid plan for going forward both technologically and roll-out wise.

There are lots of blockchain projects out there. A lot of them are a sham and a money grab, some are “scientific experiments”, and only a few are working hard on bridging the best technology and science with the real world applications in a genuine attempt to make a fundamental difference. We would like to believe that GRAFT is one of these projects. GRAFT is designed to make the best blockchain-based ideas fit together as puzzle pieces to form a solution that works now and in the future, is flexible and adjustable, lowers the bar to adoption on all sides, provides earning opportunities, and adheres to privacy and security standards of parties involved. It’s not a trivial undertaking, but we believe wholeheartedly that it’s a doable one and it’s never been as close as it is now to come to fruition!

We’d like to think that we know enough to not make mistakes, but we do make them from time to time. What’s important is that we learn from these mistakes and make quick corrections.

If there was one thing we’d like to leave you with at this point is keep challenging us in a constructive manner – we’re listening! And keep rooting for GRAFT! Turbulent times like what the market is experiencing, provide opportunities for the best projects to pull ahead and shine. Big things will come, we just need to be patient and persevere.

Sincerely,

GRAFT Team