The Blockchain Payment solutions space has recently become a very hot topic, with both legitimate developments and a multitude of questionable claims. This article attempts to separate facts from fiction by outlining the lay of the land and Graft’s competitive positioning based on our view of the space.

With that in mind, let’s start with some definitions of key components of the electronic payment chain:

Payment processor — a service provider that processes a payment authorization, settles the transaction, and deposits a merchant payout.

Payment network — a network (or protocol) that provides an infrastructure for processing payments by coordinating the activity among multiple participating parties.

Payment gateway — a service that provides access to a payment network. These categories are important when deciphering what various providers are trying to do.

Centralized Payment Processors

The first class of payment solutions that are operating today are the centralized payment processors such as Coinbase and Bitpay. To enable crypto payments, these players simultaneously act as a payment gateway, a payment processor, and a clearing house. There’s nothing significantly wrong with this approach other than the fact that 1) it goes against the principles of decentralization; 2) it’s not a network, but rather a single entity; 3) it doesn’t scale very well because a payment processor needs to be able to handle an unlimited volume of the transactions and provide cross-border support; and 4) they represent a single point of failure and, more importantly, a single point of attack making themselves extremely attractive to hackers.Solution Integrators

Integrators usually take existing blockchains and make them work for a specific use case. In the case of payments, they would be the “last mile” solution for making Dash, for example, work at the point of sale. Integrated solutions usually work okay but they only support specific point-of-sale systems, specific merchants, and have limited flexibility. They also decide who gets to participate in the ecosystem and they essentially act as a bank by fulfilling a lot of the clearinghouse functions themselves.Payment Blockchains

This category includes legitimate blockchain projects that attempt to facilitate cryptocurrency payments. Dash and Ripple are good examples of payment blockchains, as they have made significant advances in facilitating the use of blockchains for payments. Dash implemented on-demand privacy and on-demand speed, whereas Ripple implemented inter-blockchain swaps.Payment Networks

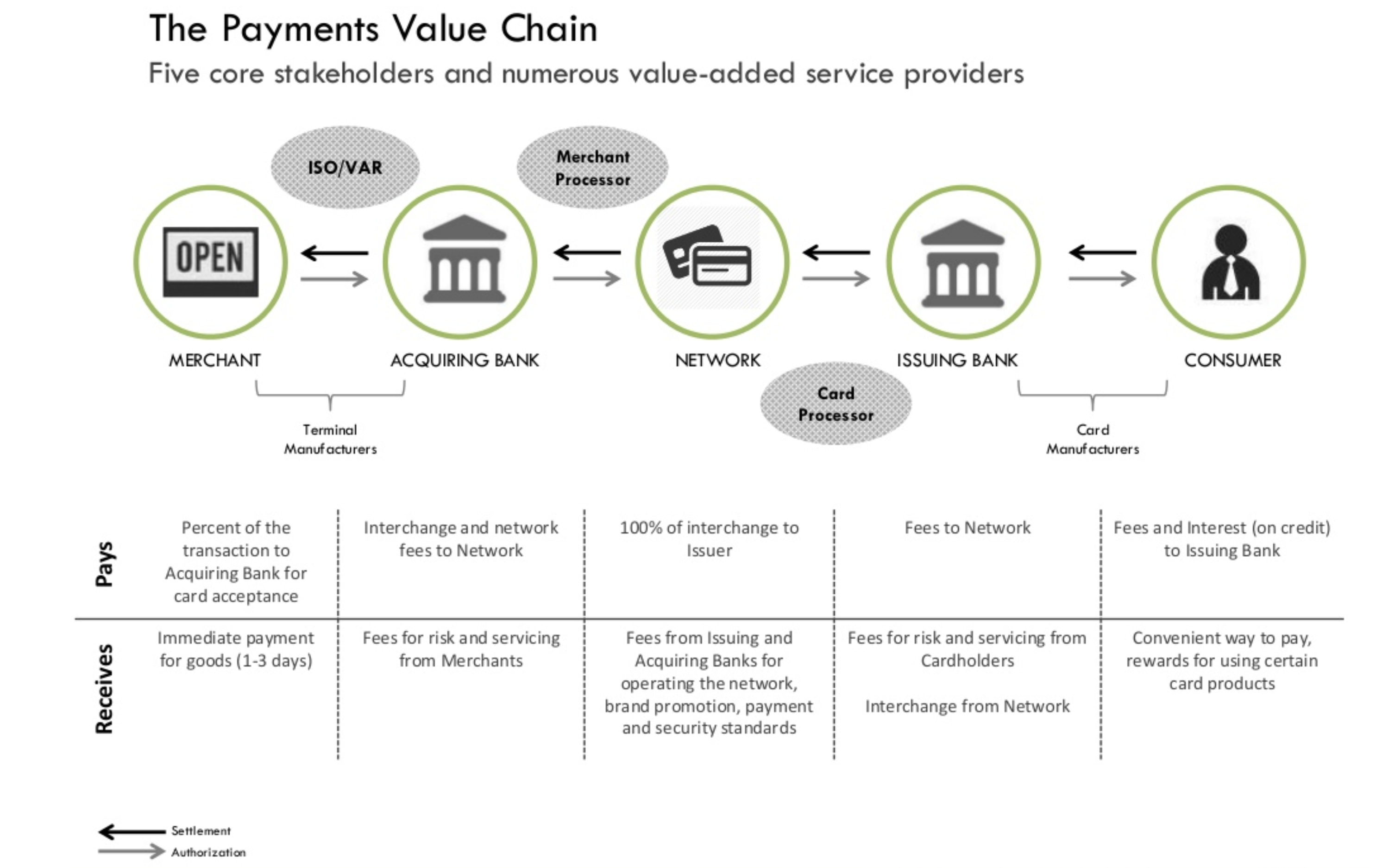

Payment network implies that there are multiple participants that are being connected together to form a network. In the case of traditional credit/debit card processing networks, they are bridging the issuing banks, acquiring banks, and payment processors into something that works in the context of a single transaction.

Source: PYMNTS.com

Processing a payment at the point of sale is a complex chain of events that includes obtaining pre-authorization or authorization from the issuing bank through the acquiring bank, putting funds on hold, releasing the payment for settlement, and, finally, clearing the payment by transferring the funds from the user’s issuing bank to the merchant’s bank account.

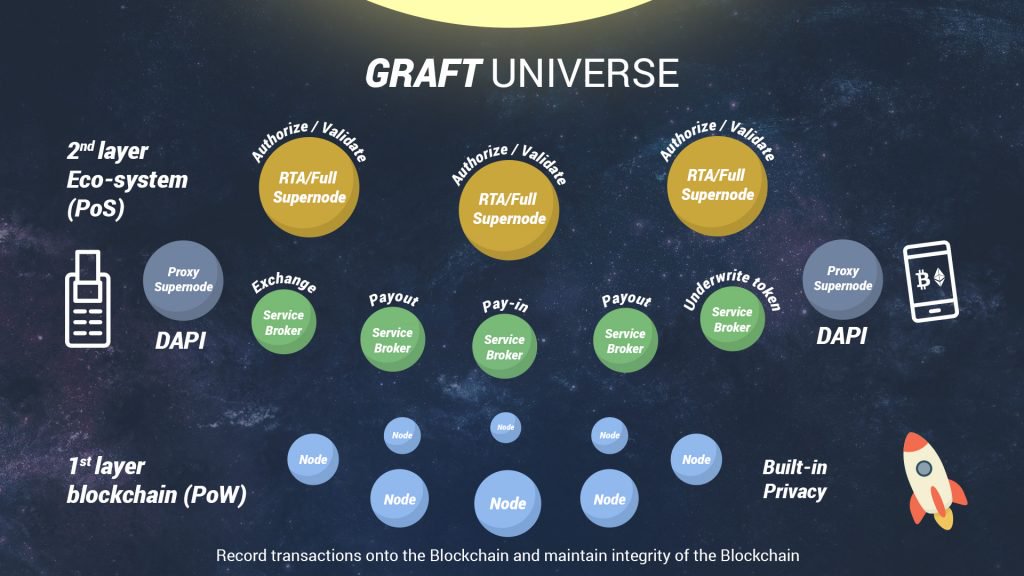

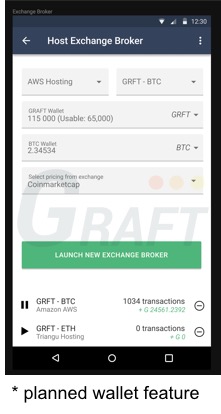

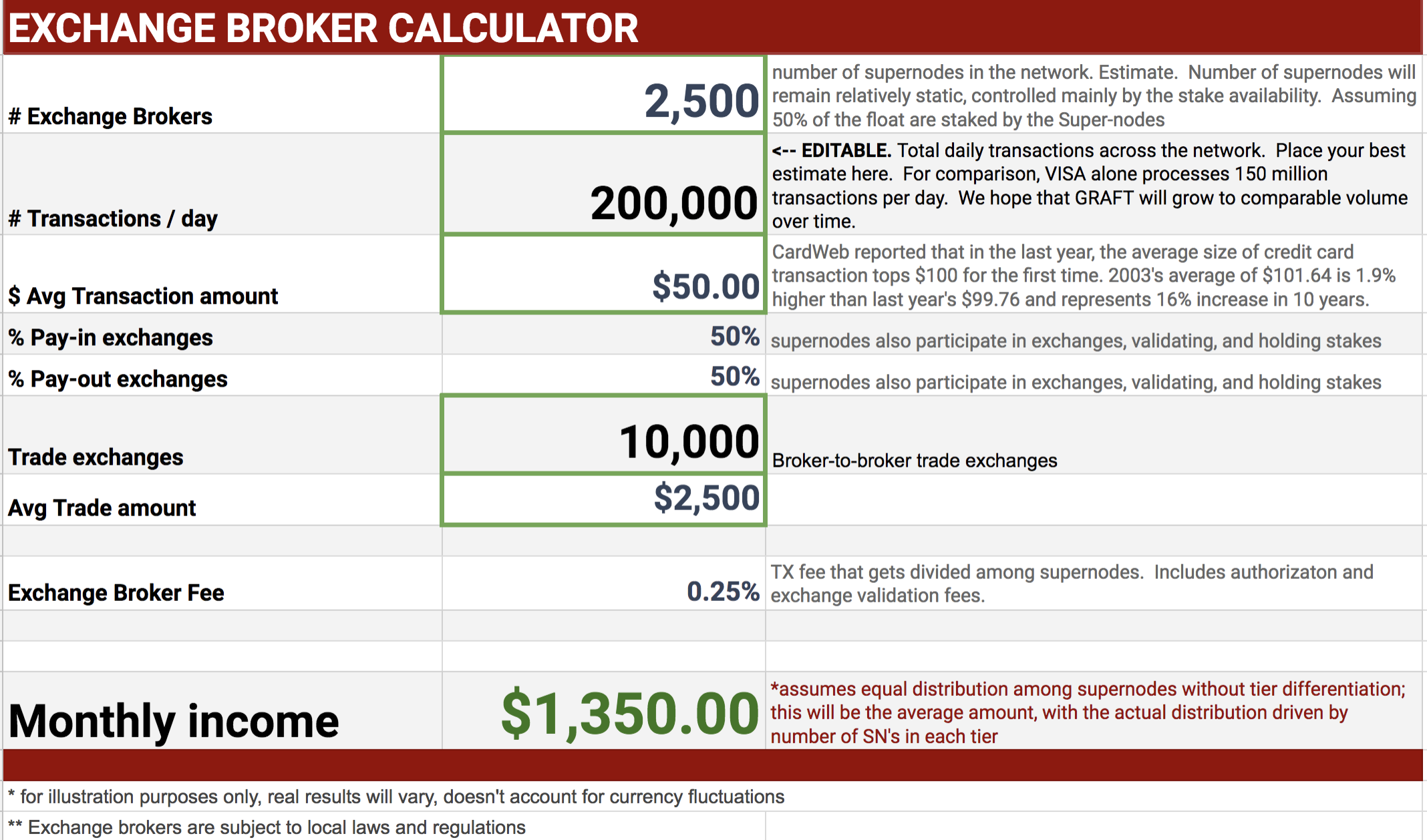

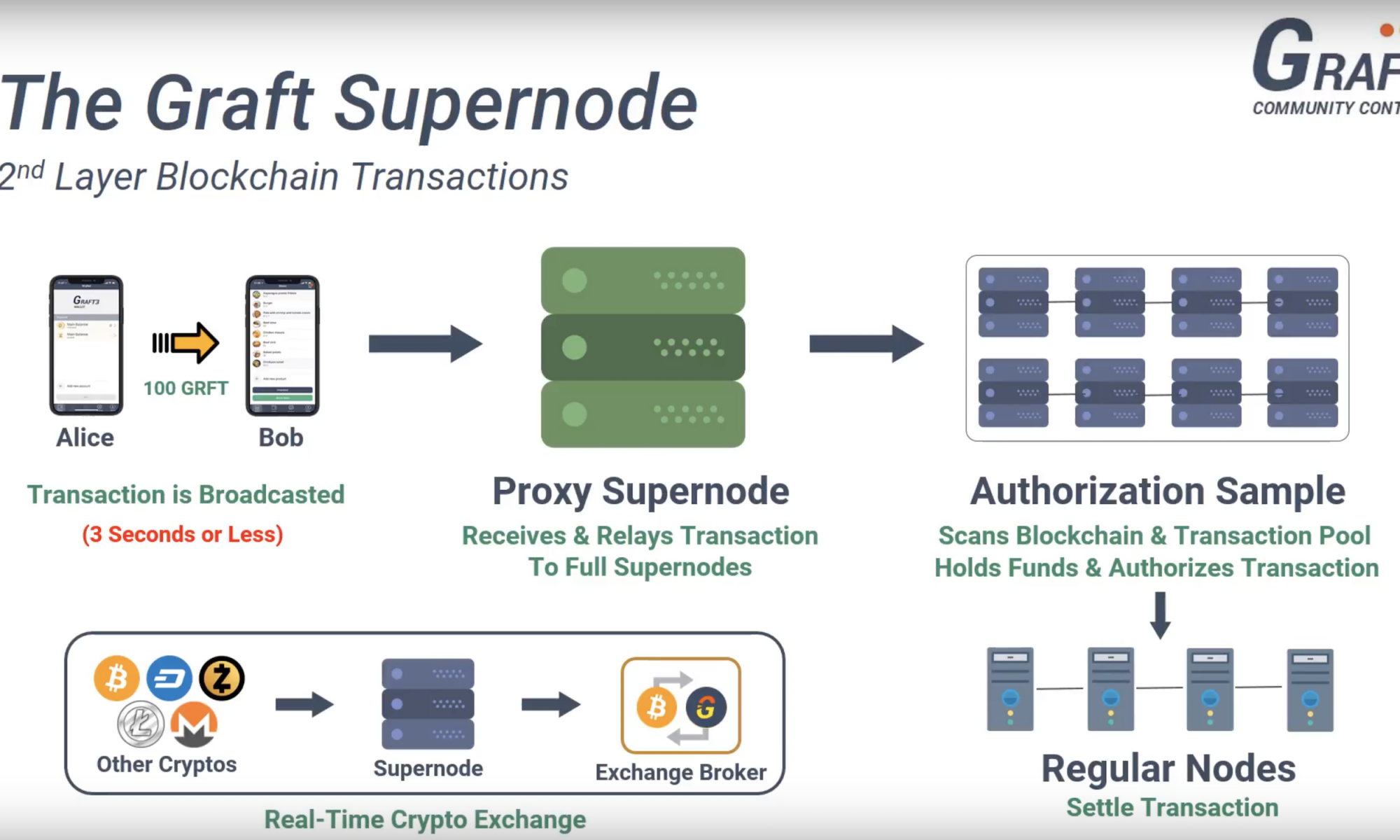

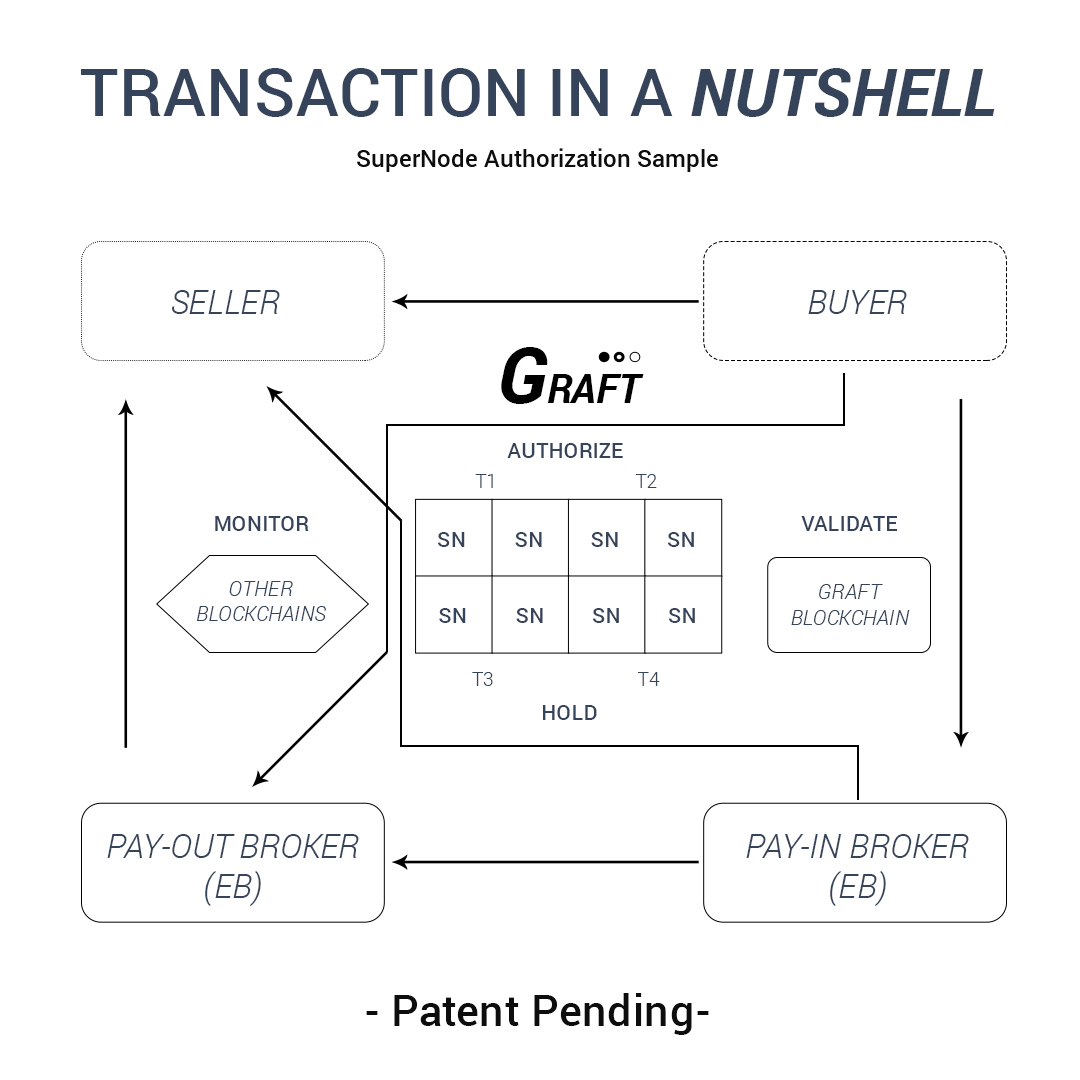

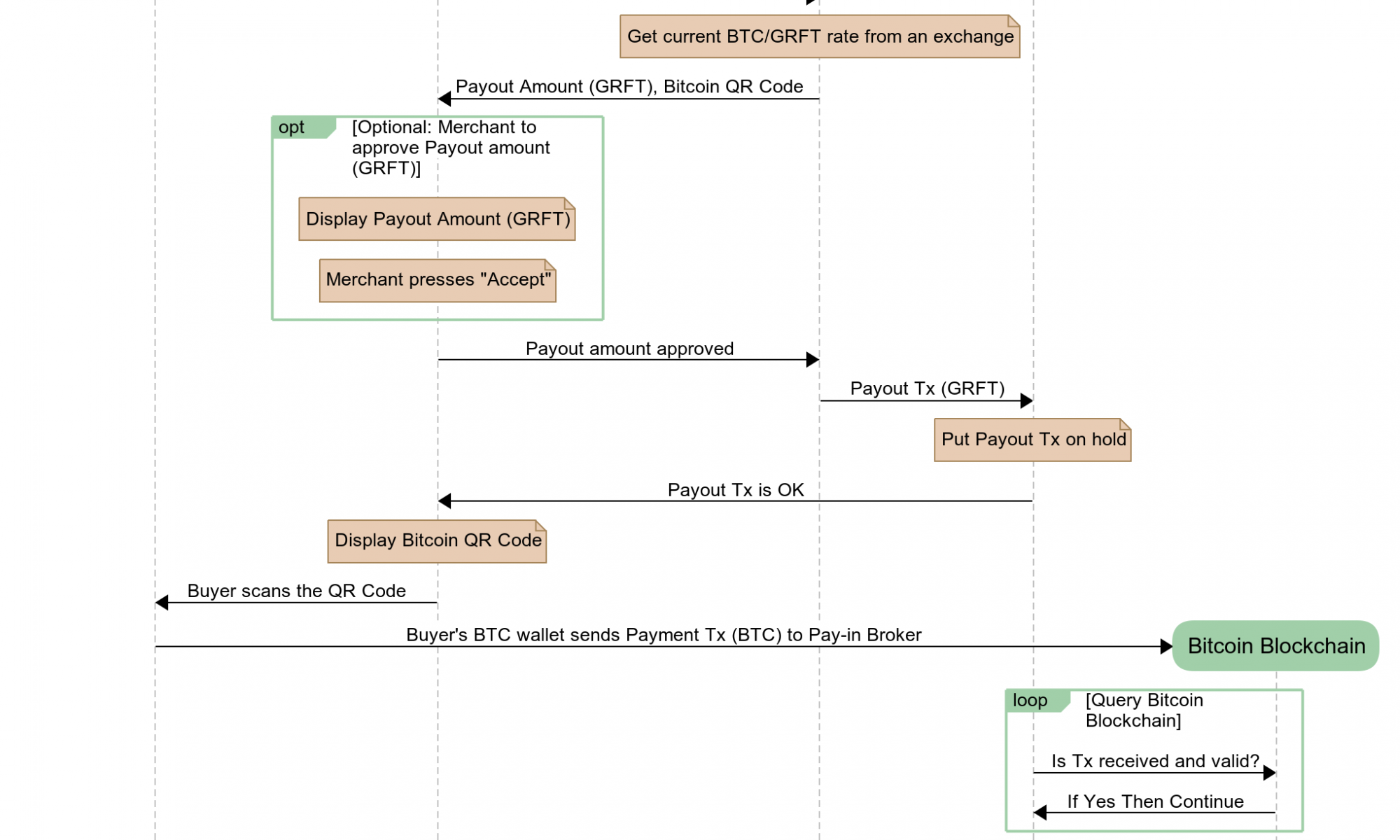

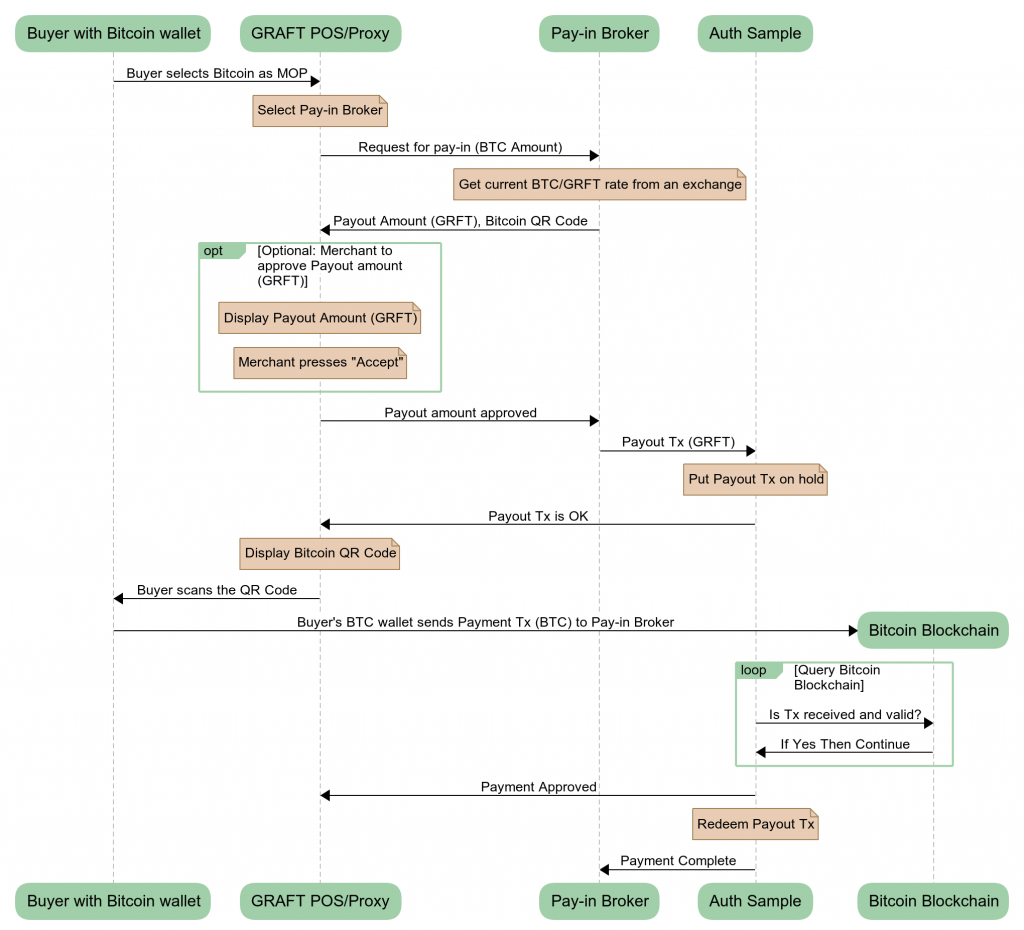

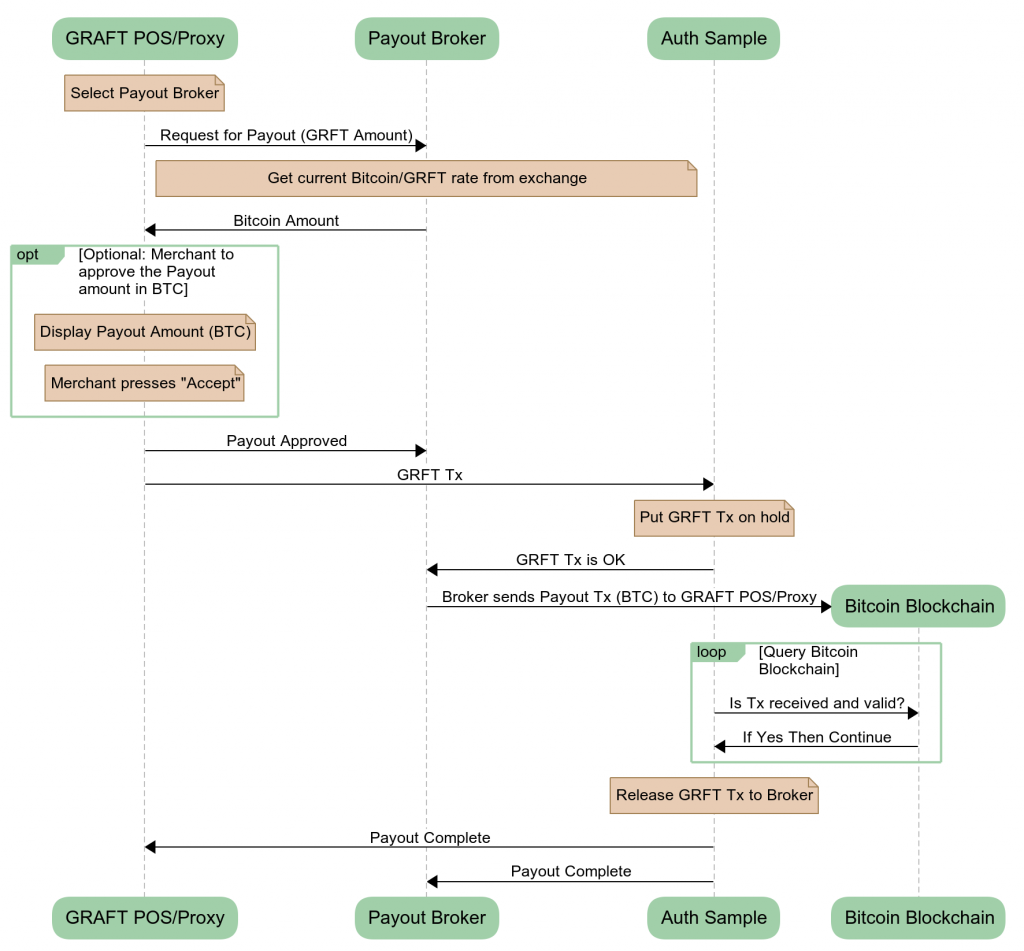

In the case of cryptocurrencies, use of such a network implies pre-authorization by verifying and placing funds on hold in real-time, transferring the payment from the payer’s wallet in the currency of their choice, converting that currency into the currency of choice for the merchant, and distributing the fees — all this is accomplished by accepting and coordinating services from service providers. This is exactly what a network like GRAFT is doing (while providing integration points for the point-of-sale applications, and in a decentralized manner to boot!).

There’s only one other network-like solution (other than GRAFT) that’s looking to resemble some fragment of a payment network: the Lightning Network. However, the Lightning Network concerns itself with instant currency swaps, without much regard for fees or compatibility with the merchant point-of-sale systems and processes. It also relies on pre-existing payment channels, making it suitable for repeat transactions as opposed to what you would see in the point-of-sale environment.

Suspects

Unfortunately, the blockchain space is rife with projects looking to capitalize on general lack of knowledge to pass themselves off as a legitimate payment solution in order to raise funds. They call themselves payment networks without building anything resembling a network, or a blockchain payment solution without having anything close to a viable solution. Their white papers are usually vague and full of buzzwords with little substance of the specifics of implementation. It’s often painful to watch millions, if not billions, of dollars being flushed into projects that show no signs of real technology or other innovation.Here are some “giveaways” that can help identify suspicious projects:

- They are based on ERC20, EOS, or other smart contract tokens rather than dedicated blockchains.

It’s very easy to create these tokens, but unless the project will act as a bank and take on the brunt of arbitrage in releasing the funds before they themselves collect those funds, there’s no way for them to overcome the speed issue. They are also subject to the underlying network fees that the token is built on. - They advertise a “crypto credit card” that can be processed by a traditional credit card network.

The impossibility here is that none of the traditional payment networks will license anyone but an issuing bank to accept network-backed payments. Unless the crypto credit card is backed by their own issuing bank which gets licensed by a traditional payment network (an unlikely scenario), this claim is quite dubious. Those that manage to pull off this feat will become a single-bank-backed, centralized solution, at the complete mercy of the local regulatory environment and traditional network continuous licensing. - They are creating their own point-of-sale devices.

It’s easy to private label a payment terminal found on Alibaba or similar manufacturer marketplaces. The problem with this is a merchant will not place a new terminal into the store without PCI and other rigorous certifications, not to mention that it would have to integrate with their point-of-sale software. Adding new terminal to a store, or especially a chain of stores, is an extremely difficult and expensive process which implies significant integration, certification, testing, and employee training costs that must be thoroughly justified.

Summary

There are distinct and important differences in payment solutions, with true payment networks providing the most open and flexible option for payment processing, while centralized and integrated processors can provide “point” solutions.There is quite a bit of disinformation in the cryptocurrency payment processing space, so it’s important to understand how payment ecosystems work in order to tell fact from fiction as you proceed to navigate this treacherous market space.

GRAFT vs. Others