Go-To-Market Strategy

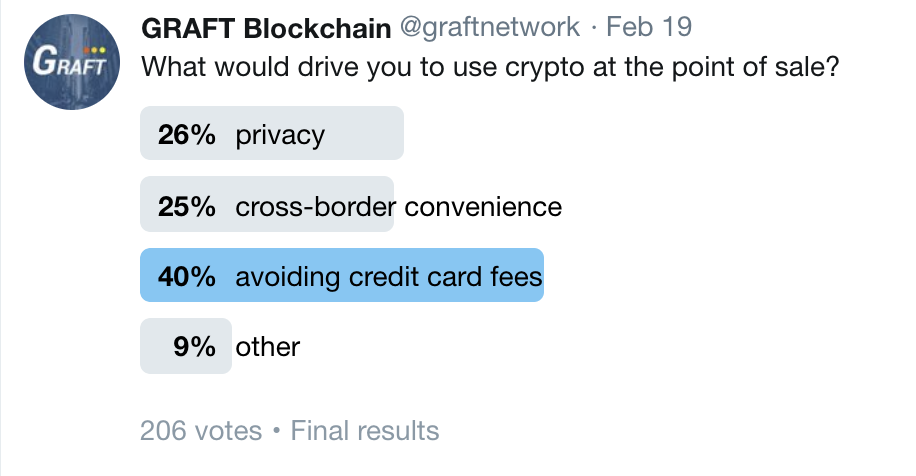

We would like to think that GRAFT network will take off on its own given the technology and integrations that we’ve put in place and continue working on, however we think we can and should do more to enable getting initial traction in the market. As we are nearing the launch of Real-time Authorizations (RTA), it’s the right time to focus again on the Go-To-Market part of the plan, taking into consideration current state of the market and evaluating ways to drive the adoption. While GRAFT’s main mission remains the acceptance of any method of payment via a fully decentralized, service broker based network, we need to find quick path to adoption that will resonate with merchants and users alike, leveraging existing demand with the technologies we’re bringing to the table.

To that end (and to create an additional revenue stream to sustain ongoing development) we have decided to set up a separate commercial entity alongside GRAFT Blockchain that will perform a payment gateway function, providing online and brick-and-mortar merchants with loyalty rewards / gift cards / store credit / promotions, crypto payment, and standard payment capabilities. We are tentatively calling this service a LoyalShopper or LoyalShopper gateway.

Gateway Service Levels

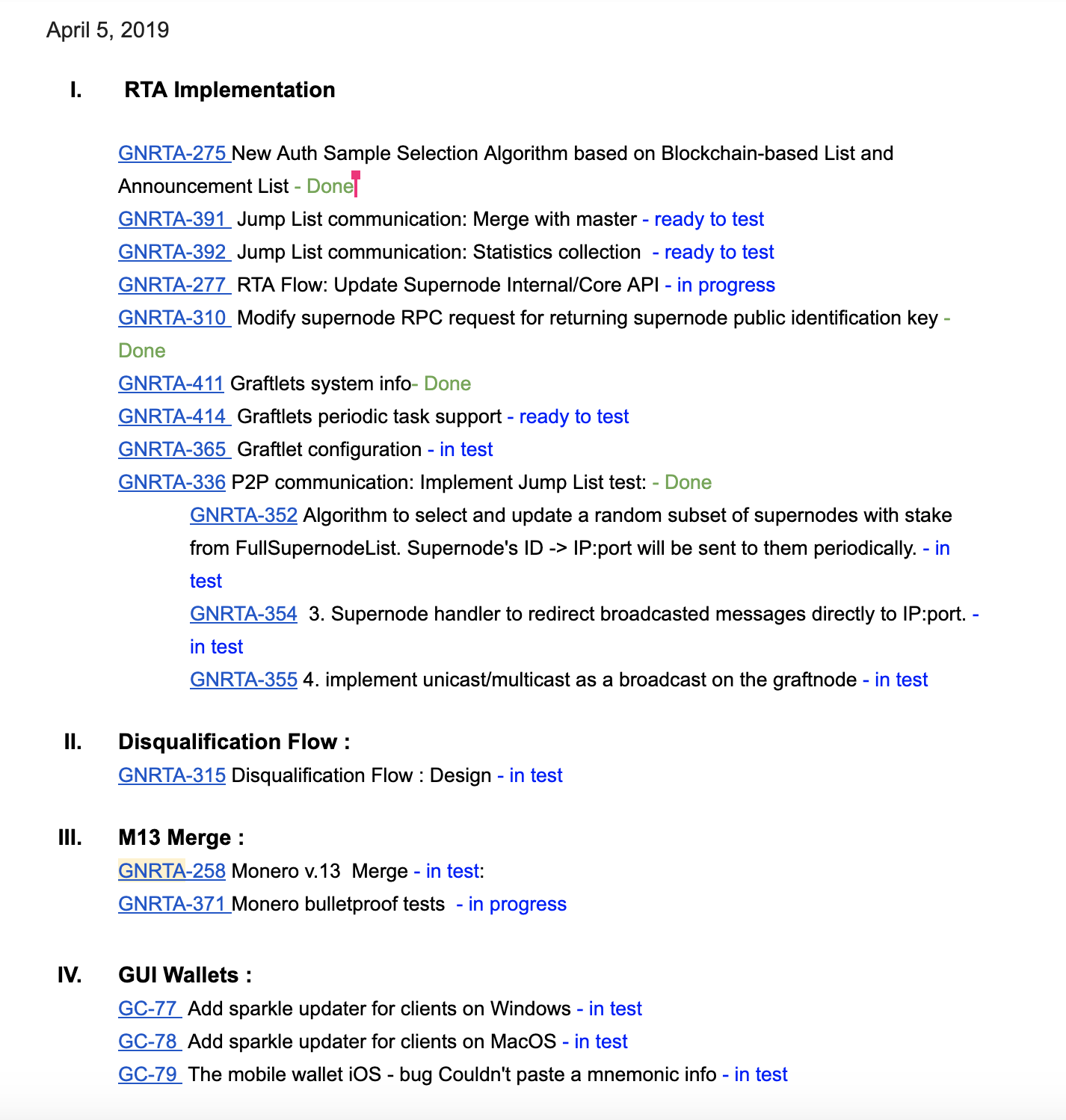

We are looking for the LoyalShopper Gateway to be available worldwide across different verticals, although local regulatory realities may force further fragmentation of the service. We will start with online ecommerce implementations, specifically Shopify, followed by WooCommerce, and BigCommerce integrations. LoyalShopper Gateway will utilize GRAFT Network for crypto acceptance and Lyra Blockchain for the loyalty reward and gift tokens. Time frame wise, we target Loyalty part of the gateway service to be available in its first rendition in late July/early August, Loyalty + Crypto by October and Loyalty+Crypto+Credit/Debit by the end of the year or early next year.

(We’re intentionally leading with loyalty functionality due to the least amount of external dependencies, broad appeal, and more straightforward integration within the Shopify framework).

LoyalShopper Gateway Functions

| Loyalty |

Crypto |

Credit / Debit Cards |

|

Issue and accept merchant tokens for loyalty rewards, gift cards, store credits, and promotions via LS provided checkout modules for specific ecommerce platforms.(facilitated by Lyra Sidechain)

Features: Portable tokens, instant transactions, persistent reward links, reversable grants for refunds, fungible and non-fungible merchant tokens. Integrations with Shopify and other e-commerce platforms in the future.

Price: packages range from FREE to $249/mo (depending on number of transactions and other added features)

|

Accept GRFT and other Alt digital tokens, currencies supported by GRAFT Network brokers.

Features: accept any digital currencies or other assets supported by the GRAFT Network exchange brokers, real-time authorizations, receive funds in fiat or stable coin.

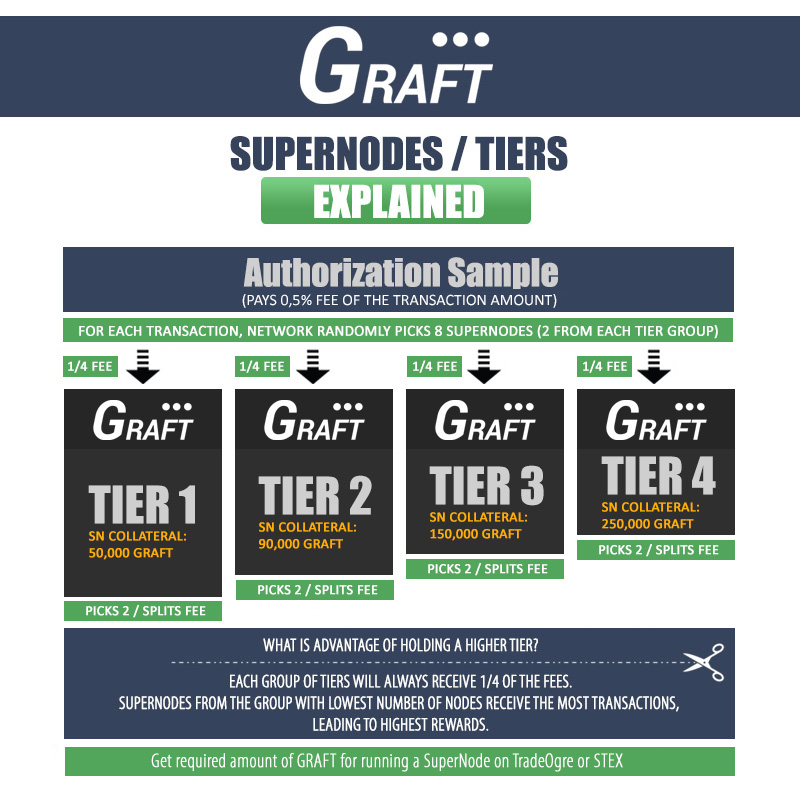

Cost to the merchant: 0.7% to the GRAFT network (split between auth sample and proxy nodes) + exchange broker fees if applicable

|

Regular credit/debit card acceptance, with fees comparable with traditional credit and debit card payments solutions

|

Effect of LoyalShopper on GRAFT Network

LoyalShopper Gateway will utilize GRAFT Network for crypto payments and Lyra Blockchain for loyalty/gift/store credit/promotions and should drive the transaction volume on each network resulting in transaction authorization fees to the Supernodes (and Lyra nodes once Lyra is decentralized).

Of course LoyalShopper will not have any exclusivity when it comes to utilizing GRAFT network – it will just serve as an example; others are encouraged to set up similar value-added payment gateways.

Integration with Shopify

We have done the initial prototype

merchant token integration with Shopify platform and have found that the most effective way to offer the loyalty / gift programs involves issuing reward and gift/store credit tokens.

When a shopper buys something from a seller, the seller can reward the shopper with some Reward tokens (“loyalty points”). The shopper keeps these tokens in their wallet until they are ready to redeem them, at which point these tokens are converted into Gift tokens which can be used at the checkout. The number of reward tokens per fiat unit is configurable by the seller.

While reward tokens are fungible, Gift tokens are implemented as non-fungible tokens because they have unique properties such as redemption code and expiration date. Gift tokens are created by the merchant during reward redemption or gift card issuing transactions, and burnt during gift redemption transaction (at checkout).

We will publish more information on the inner workings of the merchant tokens and integration with Shopify shortly.

Merchants:

Interested merchants may register

HERE to express their interest and preferences, and to be notified of the availability.

As usual, we’re open to comments and ideas from the community!

For investment opportunities, contact [email protected]

You can find the proposed community task guidelines

You can find the proposed community task guidelines

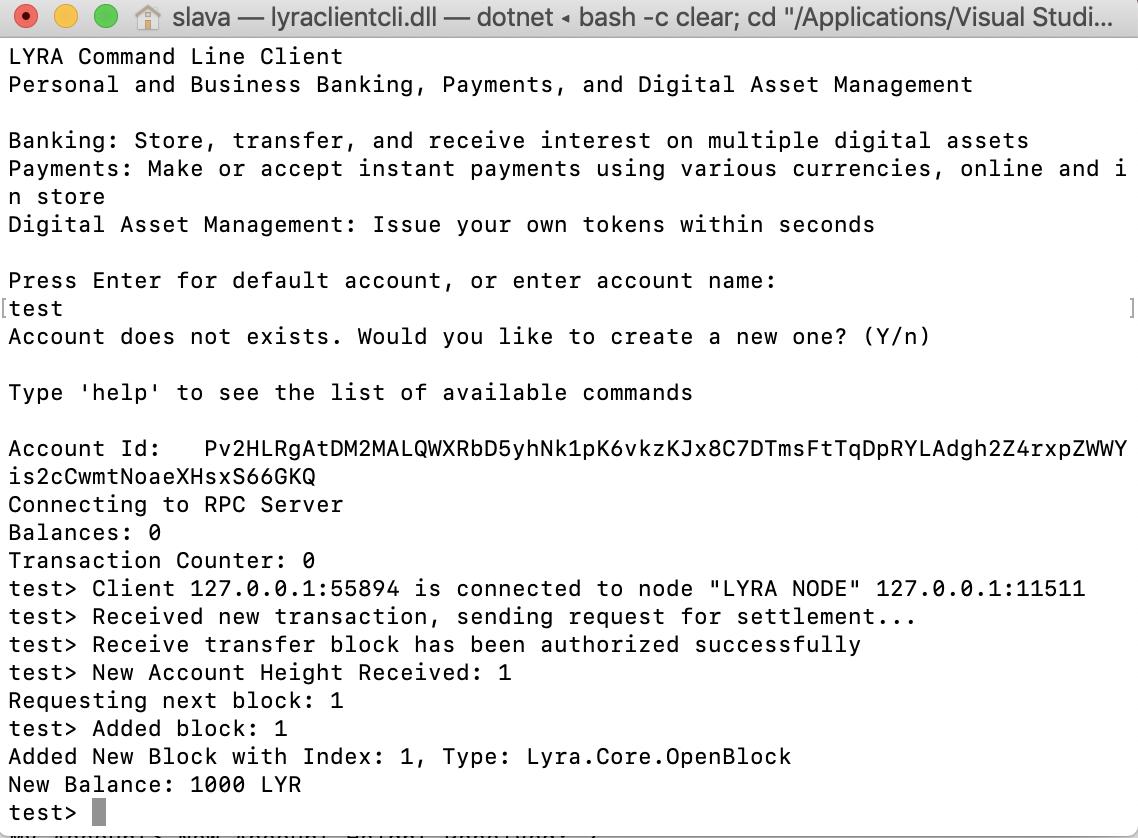

Why are we working on LYRA now?

Why are we working on LYRA now?