It’s Valentines day, so we thought it would be appropriate to show some extra love for GRAFT ?

We wanted to lift up the covers a little bit on what we’ve been thinking about over the past few months as what the future holds for GRAFT’s technology. Please meet the beginnings of LYRA DPoS*- the Next Big Thing for GRAFT Platform, based on the most recent advances in the field.

Down cycles provide an opportunity to hunker down and build a great solution in preparation for the upturn and market expansion. The market WILL return and when it does, it will reward those who have the most advanced technology for the application, so we need to be ready for that!

The keyword is BUIDL!

Enjoy the read – we hope you will come away as inspired as we have been with it!

As usual, we welcome your feedback – please use github’s issue subsystem to comment.

https://github.com/graft-project/LYRA

* DPoS stands for Delegated Proof of Stake

** GRFT isn’t going away – it will remain the voting and gas/reward currency in the new DPoS platform

Changelog:

Changelog:

As we mentioned in the previous communications, we are launching an IndieGogo campaign for the ColdPay card.

As we mentioned in the previous communications, we are launching an IndieGogo campaign for the ColdPay card.

With the campaign now and a first batch scheduled for late May / early June, we’re looking to create some good buzz in the marketplace shortly prior to, during, and shortly after RTA Mainnet launch (not to mention putting a useful product into people’s hands that reminds them of GRAFT).

There’s a limited amount of specialized development both on the card and one the provisioning interface, but that work is confined to several part- time engineers who do not participate in core development. So overall impact on the critical path core development is minimal.

Often times as engineers we have a tendency to wait to release something until it’s complete and final. This however is not always practical, especially when it comes large complex projects like RTA Supernodes.

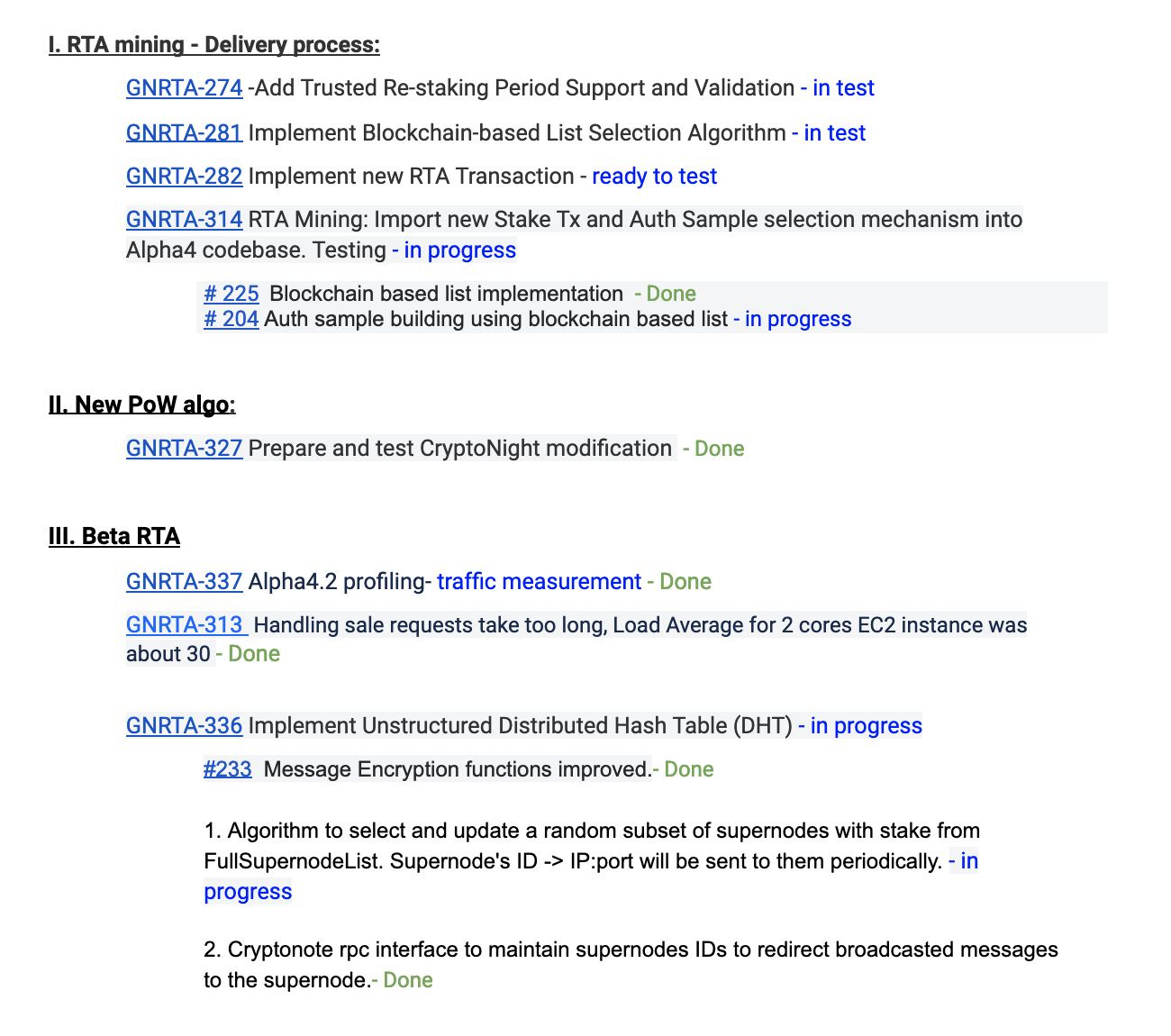

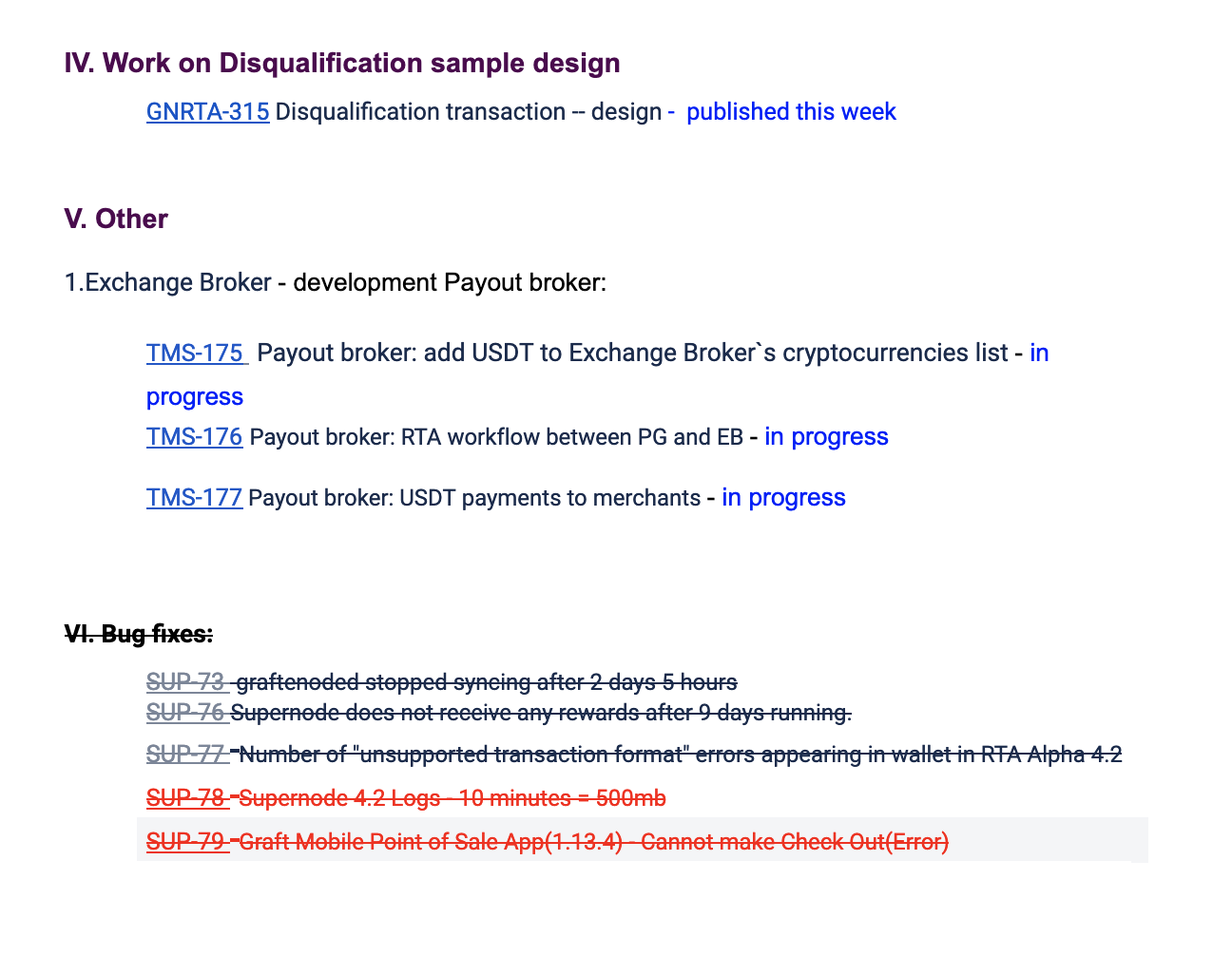

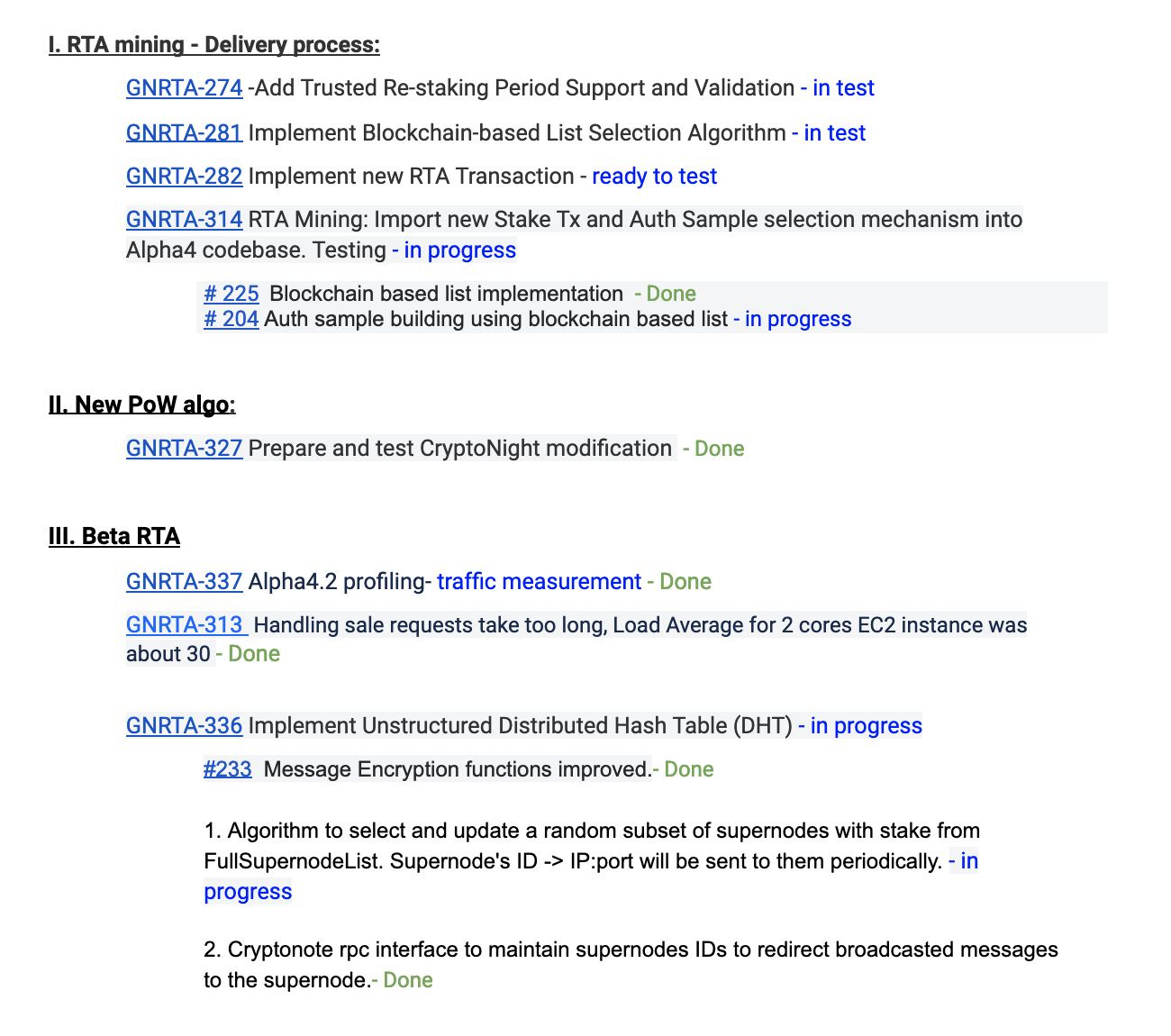

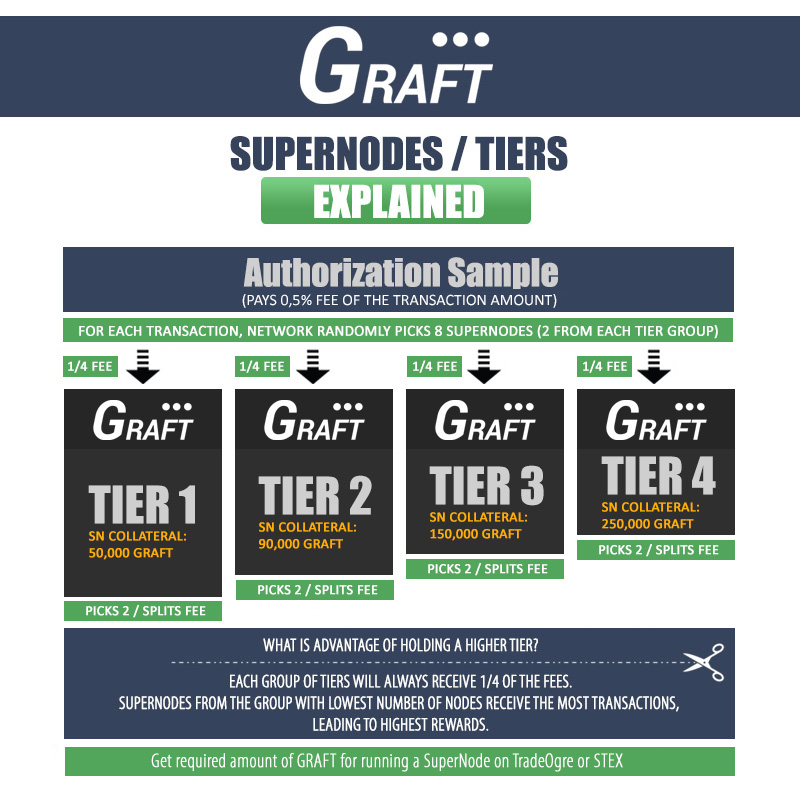

We have given it a lot of thought over the last few weeks and decided to break up the Supernode release into two phases. While we’re continuing the work on fine tuning RTA workflow and communication protocol in preparation for mainnet beta, we will first roll out what we’re calling an “RTA Miner” – an RTA Supernode that stakes, participates in RTA communication, and gets revenue from the stimulus transactions.

/>

/>

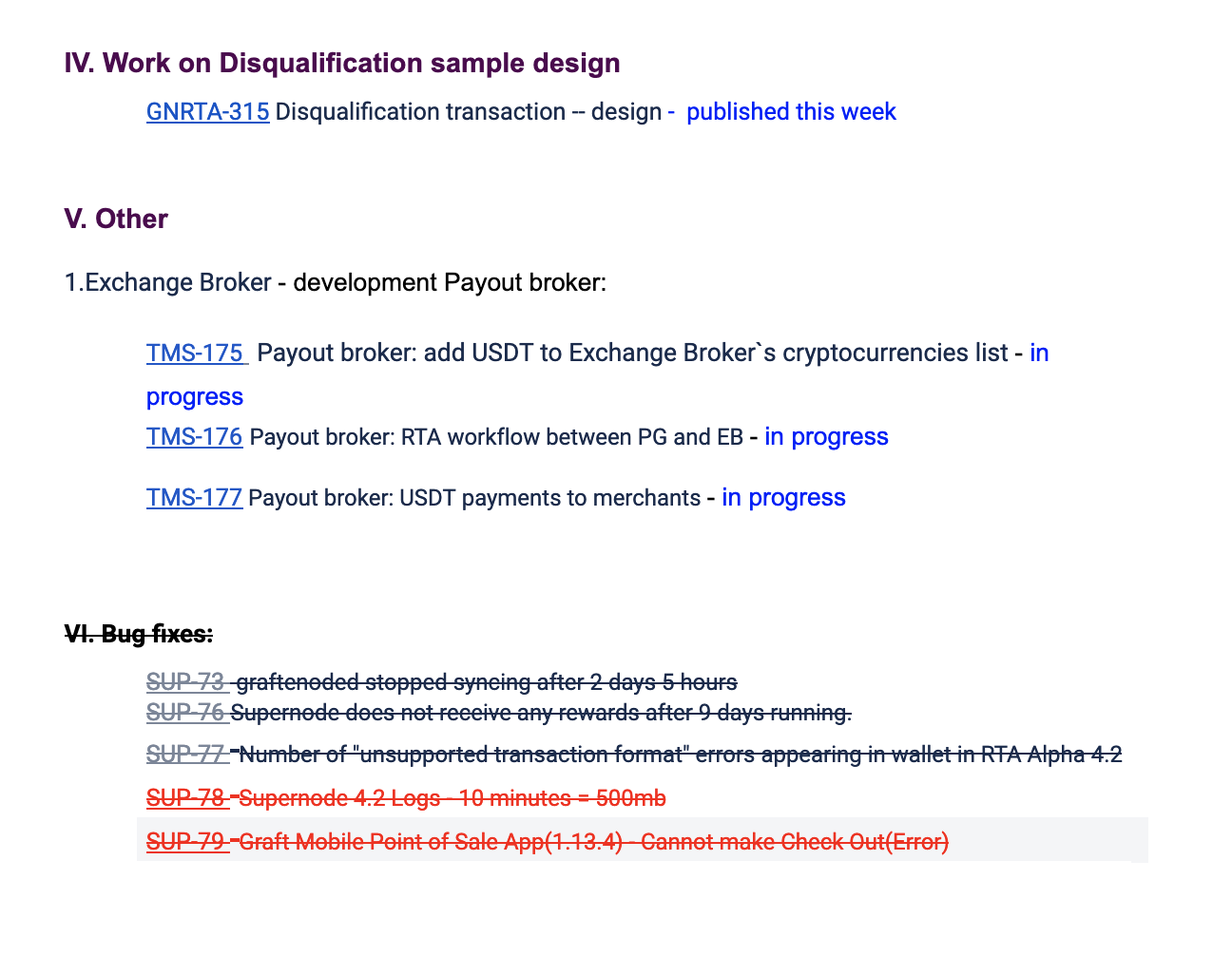

We’re excited to publish the first version of the Exchange Broker that we’ve been working on for a while in parallel to the RTA in an effort to provide a complete second layer eco-system.

https://github.com/graft-project/exchange-broker

This is the first version of the exchange broker which aims to facilitate a scenario where the merchant or merchant service provider perform the accept, exchange and payout functions. (Future versions of the broker and other components will become further decentralized and separate those functions among other participants in the network)

The broker can run on the RTA Alpha testnet and comes with a nice demo application emulating a POS/terminal accepting testnet BTC and ETH for payment.

Join the Exchange Broker Telegram channel for community-based support and idea exchange.

The new block reward formula will be as following:

reward = (M – A) * 2^-19 * 10^-10 / 2

Where M is the maximum total supply and A is the current supply.

This correction will not change the maximum supply of GRAFT that will be ever created, it will just stretch the emission curve such that it will take longer to mine the maximum supply. All GRAFT supporters should benefit from the corrected emission formula because it will stabilize the growth of the circulating supply.

In addition, GRAFT v10 will drop the mining difficulty algorithm adjustment made in the previous (v9) major network update (LWMA+tweak) and return to a standard LWMA difficulty calculation. The adjustment was originally added in an attempt to make the difficulty drop faster after a network attack, as it was believed that such network attacks were responsible for block delays and network stalls in the turbulent days between the first (v8) and second (v9) major network updates. As it turned out, however, those issues were caused by an unrelated bug inherited from Monero and have been long-since fixed on Graft’s network (the fix did not require a fork).

In retrospect, the v9 algorithm adjustment had the unintended side effect of inducing larger swings in mining difficulty because it made difficulty drop too quickly. Over time, opportunistic miners learned to exploit those difficulty swings by mining on the graft network with huge hashrates whenever difficulty dropped to win a handful of low-difficulty blocks, then leaving the network as soon as difficulty increased again. This would, in turn, result in long block times that would then trigger another difficulty drop, thus repeating the cycle. While such difficulty shifts are unavoidable, the v9 difficulty adjustment made the swings a little worse and are being removed in this fork to help make the mining difficulty more stable.

The major network update means that each GRAFT network node must be updated to the new software version before the specified block/date. Otherwise, any node that isn’t updated will be on the wrong version of the blockchain. The source code and the Linux and Windows binaries are currently available for download. The installation instructions are unchanged.

As another reminder, a major network update means that if you are running the GRAFT network node (graftnoded daemon), you must upgrade it to the current software release as soon as possible. If you do not install the updated node before block 176,000, it will be disconnected from the mainnet after block 176,000.

Note that the users of GRAFT mobile and desktop wallets will not be affected by the upcoming major network update and don’t need to do anything—as long as they are still connected to the default proxy supernodes (if you are connected to your own supernode, however, do not forget to upgrade the underlying network node to stay on the right network).

Square has made the news recently with a patent on Cryptocurrency payment network with real-time transactions.

Square has made the news recently with a patent on Cryptocurrency payment network with real-time transactions.

We’re very excited about this development as it completely validates the approach we’ve taken with the GRAFT blockchain!

Another important question one might ask is “Will GRAFT project be impacted by this development”?

We will be studying Square patent further and any action we might want to take, but we wanted to provide a brief summary of our initial thoughts on the subject:

Additionally, the fact that the patent was granted proves that there was little known prior art (GRAFT nonwithstanding) before July 2017 which is when GRAFT white paper was published and Square provisional application filed.

Finally, patent doesn’t equal product. Square and its competitors will be considering whether to develop these systems in-house or to use an existing public network like GRAFT.

All in all, we view this development as a very positive one both for the industry and for GRAFT.

With that said, we would like to ask for our community’s help in raising the visibility of the fact that GRAFT implementing the system that Square has attempted to patent – this is a very opportune time to do this building on the attention this patent has generated. Please help bring this up on the appropriate social media and discussion threads.

Exchange Brokers are a critical component of the system, paving the way for pay-how-you-want-it / receive-how-you-want-it capability. Exchange brokers (pay-in / pay-out / interchange) are open to both large and small participants. Watch the new video from All Things GRAFT about how the exchange brokers work