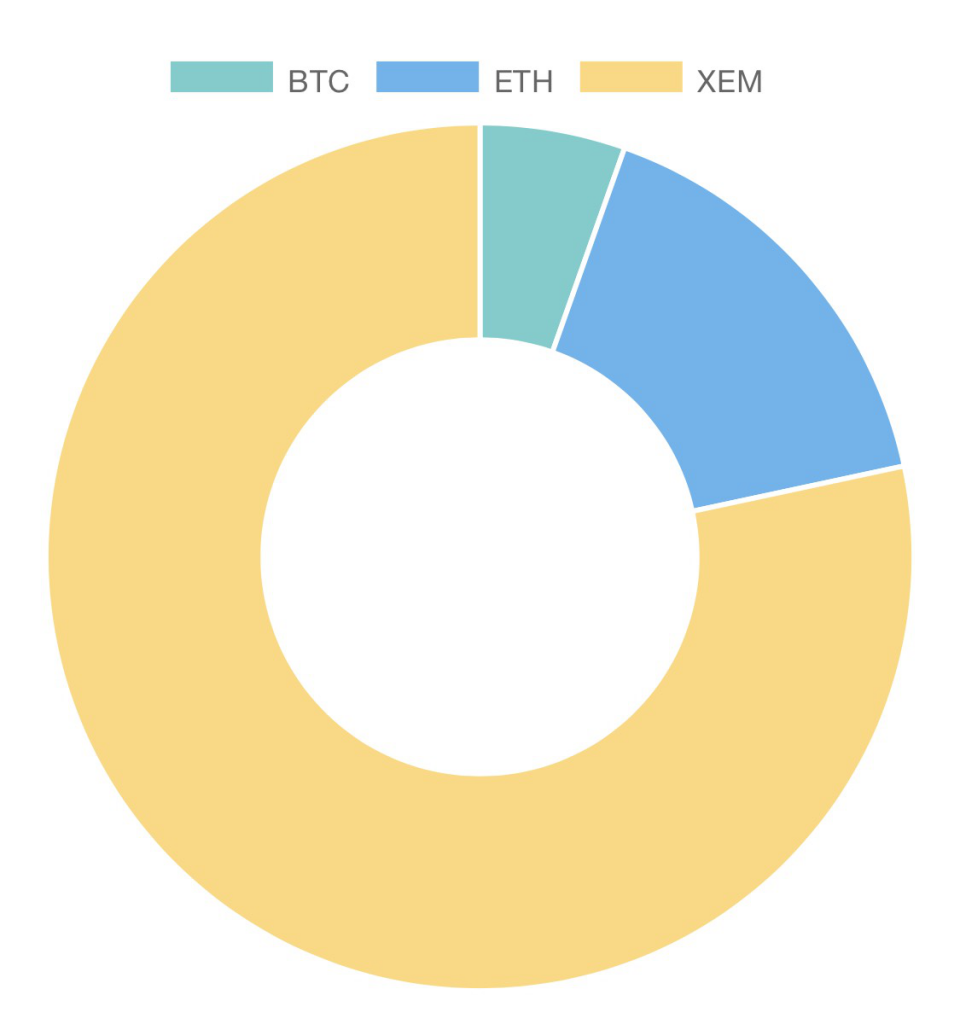

A set of cryptocurrency service brokers will be available for each major cryptocurrency listed on

https://coinmarketcap.com/, starting from the top of “top 10” by market capitalization. The service brokers will boost liquidity of each cryptocurrency by enabling various payment options on both buyer’s and merchant’s sides of the transaction. The cryptocurrency service brokers will be implemented in collaboration with existing or/and newly created exchanges. Multiple choices for each cryptocurrency eventually will be available, so they could compete in order to provide better rates and services. The variety of services and automated sign up, selection, and execution processes will keep the decentralized character of the network.

Every single set includes four service brokers implemented for each cryptocurrency. Pay-in and Top-up brokers work with the GRAFT wallet app to allow a buyer to use the selected cryptocurrency as a payment method when making a payment to GRAFT points of sale (POS), native wallet apps, non-GRAFT POS integrated with GRAFT DAPI, or non-GRAFT POS that accepts the selected cryptocurrency. Accept and Payout brokers work with GRAFT POS to allow a merchant to accept the selected as a payment method while conducting payment transactions with GRAFT wallet app or NEM wallets.

Pay-in Broker

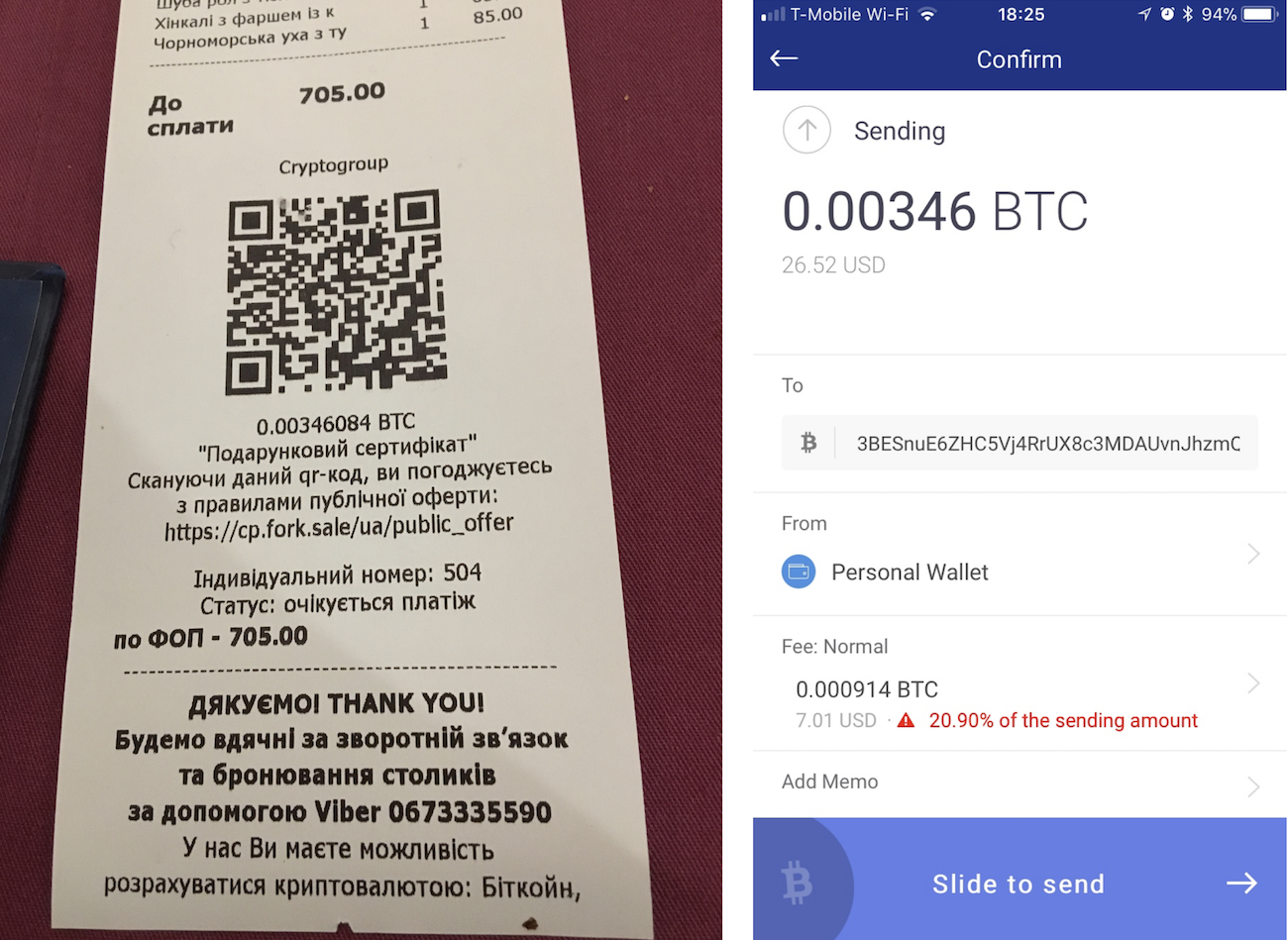

Pay-in broker works with GRAFT Wallet App to facilitate a payment to a native cryptocurrency wallet or non-GRAFT POS accepting the cryptocurrency.

In this scenario, the Pay-in Broker creates a regular cryptocurrency transaction in native format for the particular network and sends it to the native recipient address. There is a network transaction fee which is in this case charged to the sender because the transaction is not fully facilitated by the GRAFT network. The payment is not processed instantly because the recipient is not participating in Graft network. This scenario is less beneficial than GRF transaction for both buyer and merchant because of the lower speed of transaction and transaction fees paid by the buyer. However, it is supported by Graft in order to keep the buyer’s wallet flexible and useful even outside of the Graft ecosystem.

Pay-in Broker will instantly exchange necessary amount of GRF from buyer’s account to the selected cryptocurrency. The buyer pays a small exchange fee to the Pay-in Broker, which can be paid in a form of exchange rate.

Top-Up Broker

Top-Up Broker works with GRAFT wallet to perform on-demand exchange of the selected cryptocurrency to GRF in order to allow payments to GRAFT POS or non-GRAFT POS integrated with GRAFT DAPI.

This scenario is the most beneficial for both the buyer and the merchant because all the fees (including the network fees of the target cryptocurrency) are paid by the merchant, and payment is approved instantly. For the buyer, the benefits are obvious – no fees associated with the payment, and ability to pay with the target cryptocurrency to a merchant that does not accept it. For the merchant, it is important to get instant authorization in order to be able to serve more customers in real time, and accept payments in various cryptocurrencies. The fact that all the fees are paid by the merchant, just like with “traditional” credit/debit card payments, allows much better customer conversion rates.

Top-Up broker can also process exchanges on demand with larger amounts and better rates.

Accept Broker

Accept Broker works with GRAFT POS to facilitate acceptance of selected cryptocurrency as a payment method in case the buyer does not have GRAFT wallet. Accept Broker receives funds in selected cryptocurrency and converts them to GRF.

The (selected cryptocurrency) network transaction fee is still paid by the buyer, unless the buyer uses GRAFT wallet app. If the buyer uses GRAFT wallet, the wallet recognizes the GRAFT POS and automatically converts the payment transaction to instant transaction in GRF.

The merchant payout is processed by Accept Broker in GRF instantly, hourly, daily, or on demand, depending on settings, or in other cryptocurrency or fiat currency if corresponding payout brokers are activated.

From the buyer’s point of view, the transaction looks similar to regular transaction between native cryptocurrency wallets.

Payout Broker

Payout Broker works with GRAFT POS to facilitate merchant payouts in selected cryptocurrency. Payout broker exchanges GRF available on the POS account to selected cryptocurrency and makes deposits to the associated account instantly, hourly, daily, or on demand, depending on settings.

Payout Fees

Payout fees/exchange rates for payouts processed by either Accept or Payout service brokers may vary on frequency of the payout. Depending on transaction volume, daily payouts can cost significantly less than instant payouts since the broker can accumulate more funds and pay just a single network fee for single payout transaction, comparing to paying a separate fee for each instant payout transaction.

Is cryptography a science or an art? Its fruits are beautiful, and only true art can produce a beauty! Dostoevsky said “beauty will save the world.” The beauty of cryptography will save privacy and security of our world in a time of total connectivity.

Is cryptography a science or an art? Its fruits are beautiful, and only true art can produce a beauty! Dostoevsky said “beauty will save the world.” The beauty of cryptography will save privacy and security of our world in a time of total connectivity.

A set of cryptocurrency service brokers will be available for each major cryptocurrency listed on

A set of cryptocurrency service brokers will be available for each major cryptocurrency listed on  [edsanimate_end]

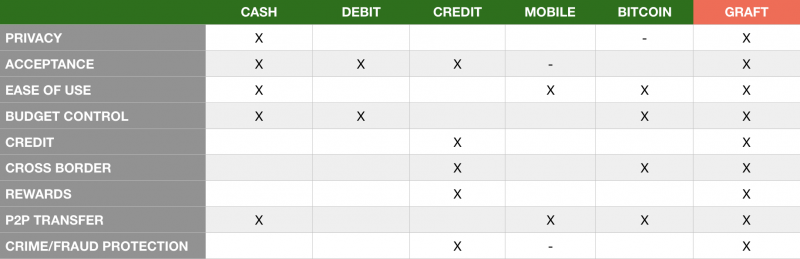

GRAFT Network enables crypto payments to work similarly to other payment processing networks (like Visa, Mastercard, Amex) by supporting special functions such as instant authorizations, merchant paid fees, etc

GRAFT tokens are the lifeblood of GRAFT Network and are used as a specialized interim medium which provides the functions needed for POS-style payment processing.

GRAFT tokens are also used for Proof-of-Stake protocol (where the credibility of the nodes is proven by presenting the network token ownership.)

[edsanimate_end]

GRAFT Network enables crypto payments to work similarly to other payment processing networks (like Visa, Mastercard, Amex) by supporting special functions such as instant authorizations, merchant paid fees, etc

GRAFT tokens are the lifeblood of GRAFT Network and are used as a specialized interim medium which provides the functions needed for POS-style payment processing.

GRAFT tokens are also used for Proof-of-Stake protocol (where the credibility of the nodes is proven by presenting the network token ownership.)