It seems we can’t find what you’re looking for. Perhaps searching can help.

Recent Posts

- Community Seed Nodes ReleaseDecember 19, 2023A new release is available, which utilizes community […]

- Graft Network’s Newly Developed Mining Algorithm is the New Talk of the Town!September 7, 2021In this fast-paced and revolutionized world, crypto […]

Engineering Update and Progress towards Community Development ModelJune 14, 2019Good day/evening/morning GRAFTers! We wanted to start […]

Engineering Update and Progress towards Community Development ModelJune 14, 2019Good day/evening/morning GRAFTers! We wanted to start […] Bulletproofs MergeJune 7, 2019Yesterday the network was upgraded to […]

Bulletproofs MergeJune 7, 2019Yesterday the network was upgraded to […] Go-to-Market Strategy Update – LoyalShopper Payment GatewayMay 23, 2019Go-To-Market Strategy We would like to think that […]

Go-to-Market Strategy Update – LoyalShopper Payment GatewayMay 23, 2019Go-To-Market Strategy We would like to think that […] GRAFT Slide Deck. All the Why’s, What’s, and How’s in One Place.April 25, 2019

GRAFT Slide Deck. All the Why’s, What’s, and How’s in One Place.April 25, 2019 Dev Update – WW14 2019 – RTA, M13, LYRAApril 6, 2019LYRA Update We hit a big first milestone with LYRA […]

Dev Update – WW14 2019 – RTA, M13, LYRAApril 6, 2019LYRA Update We hit a big first milestone with LYRA […] New Update Release – SN v1.0.3, CN v1.7.4March 29, 2019CryptoNode v1.7.4 […]

New Update Release – SN v1.0.3, CN v1.7.4March 29, 2019CryptoNode v1.7.4 […] Are the Merchant Interested in Decentralized Payment Network? – Survey ReportMarch 27, 2019Last night we published a report on Medum – Are […]

Are the Merchant Interested in Decentralized Payment Network? – Survey ReportMarch 27, 2019Last night we published a report on Medum – Are […] Disqualification Flow RFCMarch 26, 2019A Disqualification Flow Request for Comments (RFC) has […]

Disqualification Flow RFCMarch 26, 2019A Disqualification Flow Request for Comments (RFC) has […] Full Supernode Release -Stimulus Mode-March 15, 2019As promised, we’re very happy to be delivering the […]

Full Supernode Release -Stimulus Mode-March 15, 2019As promised, we’re very happy to be delivering the […] Supernode Mining Release and Stimulus PlanMarch 11, 2019As we are nearing the “Supernode Mining” mainnet […]

Supernode Mining Release and Stimulus PlanMarch 11, 2019As we are nearing the “Supernode Mining” mainnet […] Engineering Update – March 6, 2019March 7, 2019

Engineering Update – March 6, 2019March 7, 2019 Do People Really Need or Want an Alternative Payment Network at the Point of Sale and Why?March 1, 2019We recently ran a poll among Twitter followers, asking […]

Do People Really Need or Want an Alternative Payment Network at the Point of Sale and Why?March 1, 2019We recently ran a poll among Twitter followers, asking […] Development Status – Feb-26-2019February 26, 2019

Development Status – Feb-26-2019February 26, 2019 The Role of Stable Coin in GRAFT NetworkFebruary 20, 2019Recent announcement from JP Morgan about the launch of […]

The Role of Stable Coin in GRAFT NetworkFebruary 20, 2019Recent announcement from JP Morgan about the launch of […] The future of GRAFT as Delegated Proof-of-Stake (DPoS)February 14, 2019It’s Valentines day, so we thought it would be […]

The future of GRAFT as Delegated Proof-of-Stake (DPoS)February 14, 2019It’s Valentines day, so we thought it would be […] RTA Alpha 4.2February 14, 2019Alpha 4.2 is ready for testing! Release notes: […]

RTA Alpha 4.2February 14, 2019Alpha 4.2 is ready for testing! Release notes: […] ColdPay IndieGogo Campaign – Live Now!February 7, 2019As we mentioned in the previous communications, we are […]

ColdPay IndieGogo Campaign – Live Now!February 7, 2019As we mentioned in the previous communications, we are […] RTA Mining on MainnetFebruary 3, 2019Often times as engineers we have a tendency to wait to […]

RTA Mining on MainnetFebruary 3, 2019Often times as engineers we have a tendency to wait to […] Nicehash Attacks UpdateJanuary 23, 2019As many of you know, GRAFT and numerous other projects […]

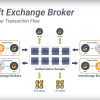

Nicehash Attacks UpdateJanuary 23, 2019As many of you know, GRAFT and numerous other projects […] Pay-in Exchange Broker AlphaJanuary 21, 2019We’re excited to publish the first version of […]

Pay-in Exchange Broker AlphaJanuary 21, 2019We’re excited to publish the first version of […] Upcoming Wallet RedesignJanuary 15, 2019There are lots of cool features we’re planning for […]

Upcoming Wallet RedesignJanuary 15, 2019There are lots of cool features we’re planning for […] Enterprise Perks and Rewards on GRAFT BlockchainDecember 19, 2018Paypal recently revealed that it was playing around […]

Enterprise Perks and Rewards on GRAFT BlockchainDecember 19, 2018Paypal recently revealed that it was playing around […] How GRAFT Is Similar To And At The Same Time Different From Visa And Other Payment Card Networks (Part 2)November 21, 2018Slava Gomzin, Co-Founder of GRAFT In the previous post […]

How GRAFT Is Similar To And At The Same Time Different From Visa And Other Payment Card Networks (Part 2)November 21, 2018Slava Gomzin, Co-Founder of GRAFT In the previous post […] How GRAFT Is Similar To And At The Same Time Different From Visa And Other Payment Card Networks (Part 1)November 20, 2018Slava Gomzin, Co-Founder of GRAFT GRAFT Network is […]

How GRAFT Is Similar To And At The Same Time Different From Visa And Other Payment Card Networks (Part 1)November 20, 2018Slava Gomzin, Co-Founder of GRAFT GRAFT Network is […] RTA Public Alpha ReleaseNovember 12, 2018GRAFT Development Status Update November 12, 2018 […]

RTA Public Alpha ReleaseNovember 12, 2018GRAFT Development Status Update November 12, 2018 […] CASH, CREDIT, OR GRAFT?November 9, 2018One good question that comes up often is Do people […]

CASH, CREDIT, OR GRAFT?November 9, 2018One good question that comes up often is Do people […] GRAFT “Anti-ASIC” Major Network Update 1.5 on October 31, 2018October 23, 2018Last Updated: October 25, 2018 GRAFT developers just […]

GRAFT “Anti-ASIC” Major Network Update 1.5 on October 31, 2018October 23, 2018Last Updated: October 25, 2018 GRAFT developers just […] GRAFT Weekly Development Status Update October 22nd, 2018October 22, 2018Hi everyone, this is our weekly update on GRAFT […]

GRAFT Weekly Development Status Update October 22nd, 2018October 22, 2018Hi everyone, this is our weekly update on GRAFT […] GRAFT Weekly Development Status Update October 15th, 2018October 15, 2018It’s been another hard working week for GRAFT devs, […]

GRAFT Weekly Development Status Update October 15th, 2018October 15, 2018It’s been another hard working week for GRAFT devs, […] AMA With the Devs – October 18thOctober 12, 2018Have a burning question about the GRAFT Network? […]

AMA With the Devs – October 18thOctober 12, 2018Have a burning question about the GRAFT Network? […] GRAFT Development Status Update October 8, 2018October 8, 2018It’s been a week since the previous dev status update, […]

GRAFT Development Status Update October 8, 2018October 8, 2018It’s been a week since the previous dev status update, […] Incentives for Full SupernodesOctober 4, 2018Any network needs to be stimulated to get off the […]

Incentives for Full SupernodesOctober 4, 2018Any network needs to be stimulated to get off the […] Engineering Update: Pay-in Broker and Payment Gateway DemoSeptember 28, 2018While we’ve been focusing on stabilizing the […]

Engineering Update: Pay-in Broker and Payment Gateway DemoSeptember 28, 2018While we’ve been focusing on stabilizing the […] Real-time Transactions – GRAFT vs Electroneum, etc.September 20, 2018Electroneum recently announced real-time transactions […]

Real-time Transactions – GRAFT vs Electroneum, etc.September 20, 2018Electroneum recently announced real-time transactions […] GRAFT Major Network Update 1.4.2 (“v10”)September 11, 2018As previously announced, we have released network node […]

GRAFT Major Network Update 1.4.2 (“v10”)September 11, 2018As previously announced, we have released network node […] GRAFT Development Status Update September 2018September 7, 2018It’s time for another dev update! It’s no secret that […]

GRAFT Development Status Update September 2018September 7, 2018It’s time for another dev update! It’s no secret that […] RTA now working in a sales workflow!September 7, 2018Please remember this day – September 6, 2018. […]

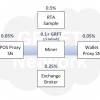

RTA now working in a sales workflow!September 7, 2018Please remember this day – September 6, 2018. […] Changes in Transaction Fee Structure: Even More Ways to Earn with GRAFT NetworkSeptember 1, 2018As the ideas initially set forth in original GRAFT […]

Changes in Transaction Fee Structure: Even More Ways to Earn with GRAFT NetworkSeptember 1, 2018As the ideas initially set forth in original GRAFT […] GRAFT Emission CorrectionAugust 31, 2018When you take a look at whattomine, mining GRAFT is as […]

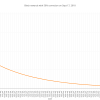

GRAFT Emission CorrectionAugust 31, 2018When you take a look at whattomine, mining GRAFT is as […] Comments on Square’s Cryptocurrency Payment Network patentAugust 31, 2018Square has made the news recently with a patent on […]

Comments on Square’s Cryptocurrency Payment Network patentAugust 31, 2018Square has made the news recently with a patent on […] Exchange Brokers Explained!August 18, 2018Exchange Brokers are a critical component of the […]

Exchange Brokers Explained!August 18, 2018Exchange Brokers are a critical component of the […] What’s Real and What’s Not in the Blockchain Payment SpaceAugust 14, 2018The Blockchain Payment solutions space has recently […]

What’s Real and What’s Not in the Blockchain Payment SpaceAugust 14, 2018The Blockchain Payment solutions space has recently […] How GRAFT is Going to Conquer the Crypto Payments World. Part 1: Blockchain and CryptoNoteAugust 9, 2018Slava Gomzin, GRAFT Co-Founder Although we have […]

How GRAFT is Going to Conquer the Crypto Payments World. Part 1: Blockchain and CryptoNoteAugust 9, 2018Slava Gomzin, GRAFT Co-Founder Although we have […] Anyone can be an Exchange BrokerAugust 3, 2018Pay-in, pay-out and interchange brokers (aka exchange […]

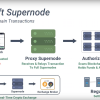

Anyone can be an Exchange BrokerAugust 3, 2018Pay-in, pay-out and interchange brokers (aka exchange […] How it works – GRAFT Super-node and Real-Time Authorizations (RTA) protocolAugust 3, 2018New Video from All Things Graft explaining GRAFT […]

How it works – GRAFT Super-node and Real-Time Authorizations (RTA) protocolAugust 3, 2018New Video from All Things Graft explaining GRAFT […] GRAFT files a patent on a Decentralized Payment NetworkJuly 30, 2018FOR IMMEDIATE RELEASE About the Patent The […]

GRAFT files a patent on a Decentralized Payment NetworkJuly 30, 2018FOR IMMEDIATE RELEASE About the Patent The […] Pay-in/Payout Exchange Brokers: Design and EconomicsJuly 27, 2018As mentioned in the original white paper, the network […]

Pay-in/Payout Exchange Brokers: Design and EconomicsJuly 27, 2018As mentioned in the original white paper, the network […] GRAFT to Release the First Supernode that Provides Real-time Authorizations for Cryptocurrency PaymentsJuly 26, 2018PRESS RELEASE – for immediate distribution July […]

GRAFT to Release the First Supernode that Provides Real-time Authorizations for Cryptocurrency PaymentsJuly 26, 2018PRESS RELEASE – for immediate distribution July […]

Categories

Download

- Mobile Wallets

- Mobile POS

- CryptoFind app

- Full RTA SuperNode

- Exchange Broker

- Payment Gateway

- WooCommerce Plugin

- Verifone Terminal Integration

Community

Marketing

- Merchant readiness report

- Media kit

- Affiliate Program

- Business Development Group on Telegram

- Merchant Marketing Materials

Partners

Blockchain

Miners

SuperNodes

GRAFT

White Paper

Conversations

- Blog

- Bitcoin Talk

- Telegram Main Group

- Telegram Business and Marketing

- GRAFT Trading on Telegram

- 官方 GraftNetwork 中文电报群

Calculators

© 2024 Graft Blockchain

GRAFT Blockchain is an open source, de-centralized, open-platform, community project with no explicit warranties or support. Play a part in payment revolution!

To support the project, donate BTC to 3832AzRcpyPfvUj3yKUvNpFZogC75YcGqv

To support the project, donate BTC to 3832AzRcpyPfvUj3yKUvNpFZogC75YcGqv