Merchant token is a simple smart contract that allows creating a private token that belongs to its owner. Unlike some other smart contract and token platforms, creation of GRAFT merchant token does not require any programming and can be done by anyone.

The business features described below are typically associated with using complex third party service providers and high implementation costs, which makes those services inaccessible for small to medium size businesses and expensive to large businesses. GRAFT Merchant tokens allow any merchant to implement those important business features with minimum efforts and low cost.

Types of Merchant Tokens

Store Credits

Store Credits are typically utilized by merchants for performing purchase returns and exchanges, when return cannot be done using the original payment method, or the merchant’s return policy does not allow the full refund. Store Credit essentially transforms return to exchange, so the merchant does not lose the customer and associated revenue.

Store Credit Token can be linked to the item price in local fiat currency, so the customer can use those tokens during next purchase “instead” of or in addition to the payment with local fiat currency. Store Credit tokens usually either do not expire or have very distant expiration date as they are basically replace the fiat currency.

Loyalty Rewards

Loyalty Rewards is powerful marketing instrument which attracts customers and increases spending. Loyalty Rewards can be awarded with each purchase, or as one-time bonus, or using other models. The rewards than can be used to makes purchases of particular items or all items, or converted to cash. Loyalty Rewards are not necessarily linked directly to fiat or crypto currency as they can be spend to provide discount or buy a special “unique” reward items that are not available for sale using other methods of payment.

Loyalty Rewards usually have relatively close expiration date. This way the merchant “stimulates” earning more rewards and eliminates accumulation of very large amounts of reward points that can become useless.

GIft Certificates

Gift Certificates can be issued by merchant in order to attract customers. In order to increase the effect, gift certificates can be sold with discount (for less than their nominal price). Gift Certificate tokens usually either do not expire or have very distant expiration date as they are basically represent the fiat currency.

Discount Coupons

Discount coupons can be used for one-time or long term promotions. The coupons can be distributed publicly or to individuals, in wallet or paper form. The coupon then can be scanned by point of sale in order to get discounted or even free item.

Transactions with Merchant Tokens

Create

Creating new merchant token (“smart contract”). Can be done using point of sale app.

Renew

Renew merchant token (“smart contract”). Can be done using point of sale app.

Add

Add more merchant tokens to the circulation.

Issue

Merchant’s point of sale sends merchant tokens to the customer wallet or prints a paper wallet.

Redeem

Customer redeems merchant tokens at merchant’s point of sale using wallet app or paper wallet.

Merchant Token Fees

All the merchant token fees are paid to the current supernode authorization sample.

Merchant Token Transaction Fees

Merchant always pays the token transaction fee, which means the buyer never pays the fee. A regular transaction fee is applied to each transaction with merchant token, including adding, issuing, and redemption. As GRAFT fees are proportional to transaction amount, the fee is calculated based on 1 token = 1 GRF, although it’s not necessarily that the token has any direct link to the GRF or other currency. It’s important to note that GRAFT fees are calculated based on logarithmical formula so there is no danger of paying high fee on large amounts.

Initialization and Renewal Fees

The initial Create transaction implies a special higher fee because it is associated with naming a token. In order to prevent “domain squatting”, the initial fee is set to a reasonable amount that prevents massive abuse. Initialization fee of 5 GRF is required to generate a new merchant token smart contract (Create transaction). The renewal fee is 10 GRF.

VChain

VChain allows creating a virtual chain of stores so multiple point of sales can be “connected’ to the same private “virtual blockchain”. Thus, there is a dual meaning of word “Vchain”: virtual chain and virtual blockchain. Vchain creates a private common platform for managing merchant tokens and items catalogue.

Merchants can create their own private vchain which is going to be accessible only by this particular merchant and contain all information about its tokens. Vchain allows connecting multiple points of sale or even creating a chain of multiple stores. Points of sale that belong to the same vchain can issue and accept the same merchant tokens, use the same shared item catalog stored and maintained on the blockchain, generate aggregated transaction reports, and more.

Buyers can use vchain to link multiple wallets so they can manage multiple accounts and move funds between those accounts without paying fees. This feature is useful for family and corporate accounts.

VChain Fees

There is initialization annual fee of 5 GRF for creating a new Vchain smart contract. The renewal fee is 10 GRF. Those fees are required to securely process the smart contract and prevent system abuse. There is a separate annual fee of 10 GRF for adding another point of sale or wallet to the vchain.

All vchain fees are paid to the current supernode authorization sample.

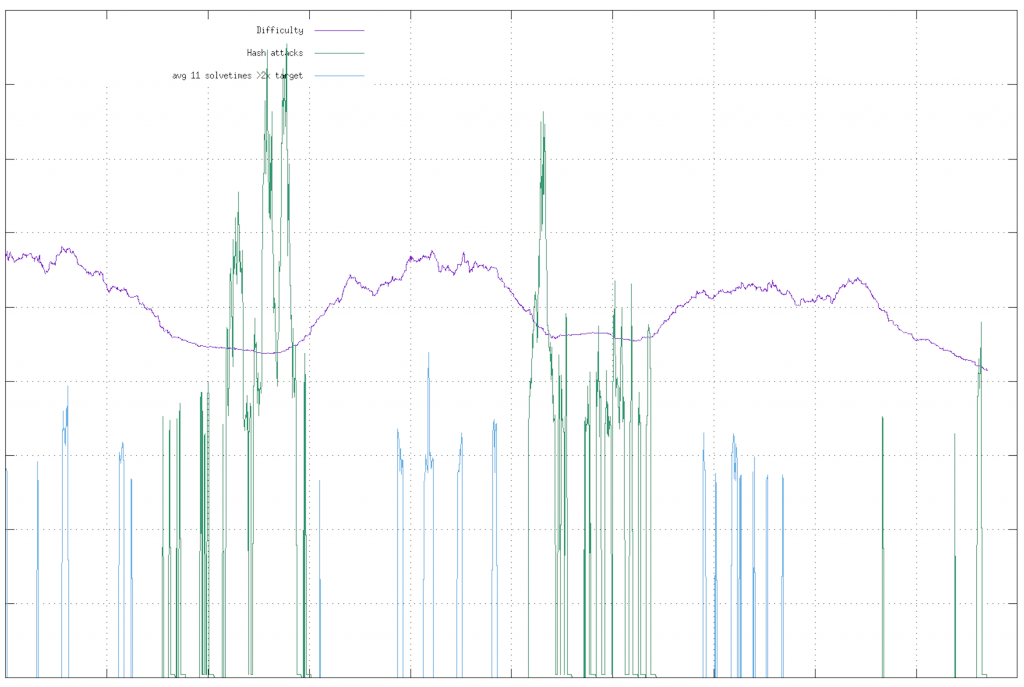

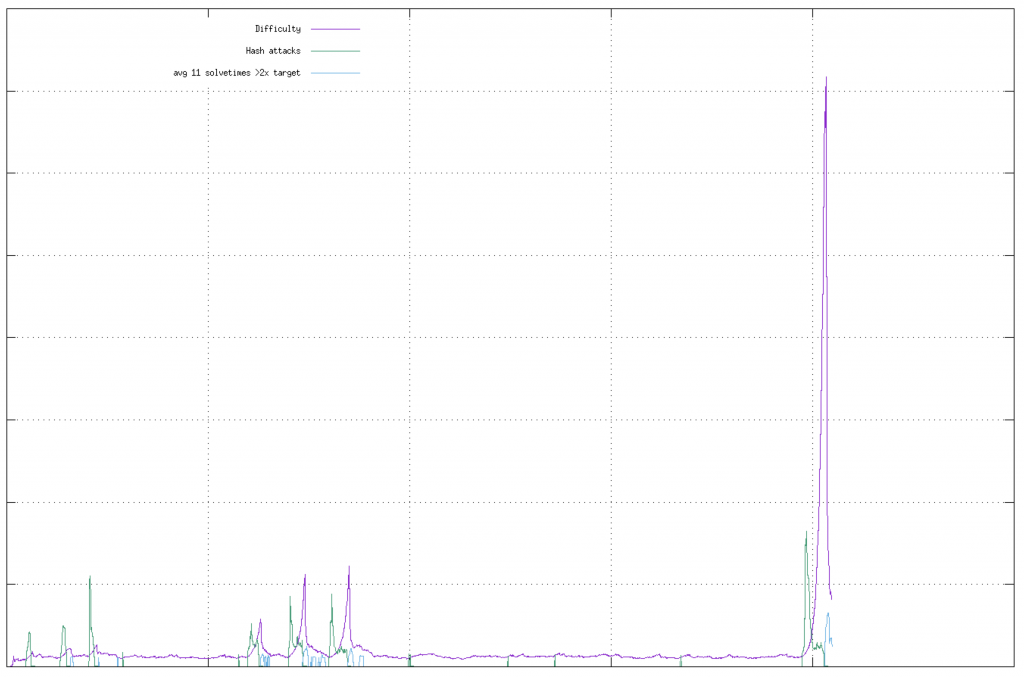

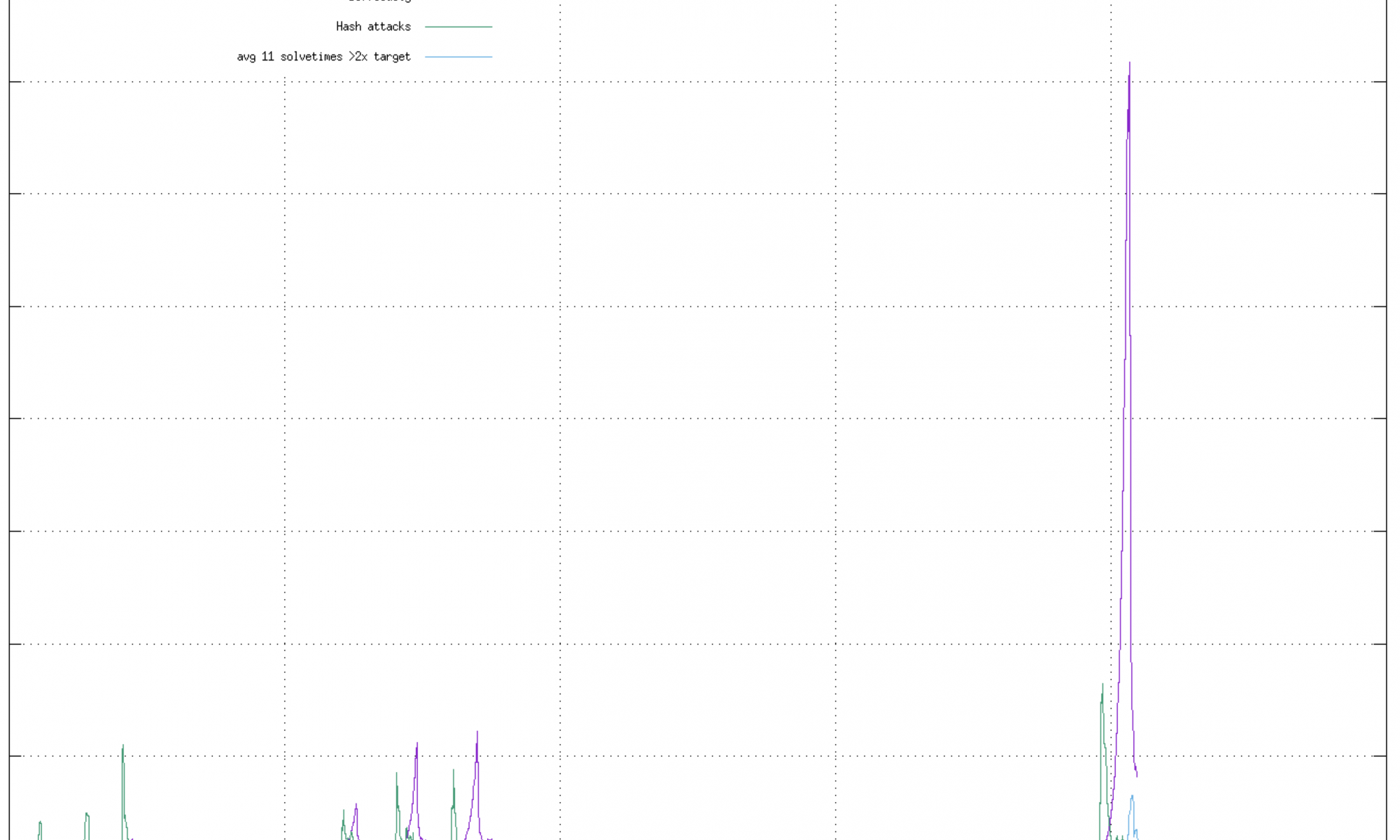

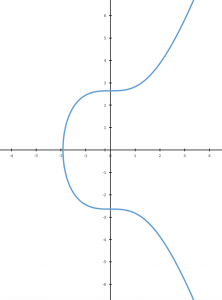

The following graph shows how the updated algorithm adjusts the difficulty much better after the simulated hashrate attacks:

The following graph shows how the updated algorithm adjusts the difficulty much better after the simulated hashrate attacks:

Although we think the upcoming network update will be sufficient to protect the blockchain from the majority of hashrate attacks, we are also working on original, even more enhanced version of the difficulty adjustment algorithm, which is supposed to provide even better, more “symmetrical” and balanced response to any hashrate fluctuations. Since such enhancements require significant testing, which is very time consuming, we are planning to include it in the next network update (the one after the upcoming update on April 6th), along with the merge of recent Monero changes. As usual, we will follow up with more details soon. Stay tuned!

Although we think the upcoming network update will be sufficient to protect the blockchain from the majority of hashrate attacks, we are also working on original, even more enhanced version of the difficulty adjustment algorithm, which is supposed to provide even better, more “symmetrical” and balanced response to any hashrate fluctuations. Since such enhancements require significant testing, which is very time consuming, we are planning to include it in the next network update (the one after the upcoming update on April 6th), along with the merge of recent Monero changes. As usual, we will follow up with more details soon. Stay tuned!

Is cryptography a science or an art? Its fruits are beautiful, and only true art can produce a beauty! Dostoevsky said “beauty will save the world.” The beauty of cryptography will save privacy and security of our world in a time of total connectivity.

Is cryptography a science or an art? Its fruits are beautiful, and only true art can produce a beauty! Dostoevsky said “beauty will save the world.” The beauty of cryptography will save privacy and security of our world in a time of total connectivity.

A set of cryptocurrency service brokers will be available for each major cryptocurrency listed on

A set of cryptocurrency service brokers will be available for each major cryptocurrency listed on