There are several major differences between Graft and Dash, but all of them are focused on the Graft’s mission to be as close as possible to the “real world” of retail, hospitality, gas stations, convenience store, or restaurant payments.

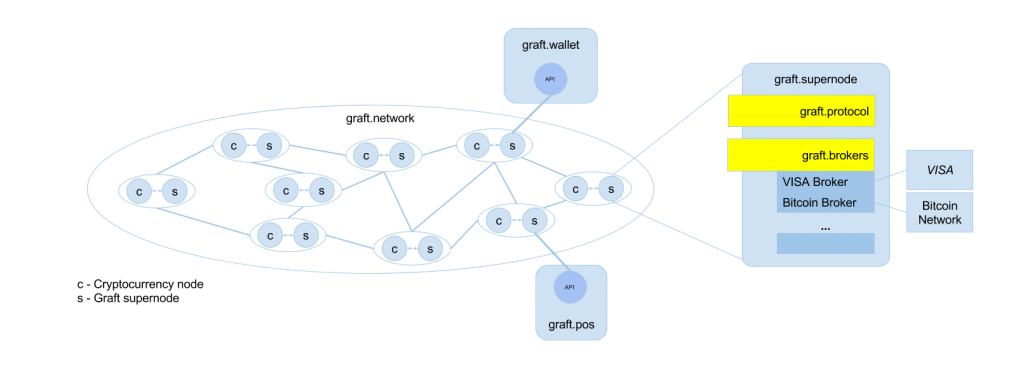

Dash’s InstandSend is an optional feature, which is implemented on top of the blockchain network protocol as a 2nd application tier. Therefore, Dash transaction can be processed in two ways: InstantSend authorization or “regular” send. If InstantSend fails for any reason, transaction is sent through the regular slow path. Such a scheme is not acceptable in the “real world” of payments. In order to “compete” with the dominance of credit cards, crypto payments must be always approved instantly. Unlike Dash, Graft real time authorization is a built-in feature: all Graft transactions are approved in real time, within a range between several milliseconds to a few seconds, depending on the merchant settings. Thus, both online and brick-and-mortar merchants and their customers can always rely on Graft real time authorization. The buyer is required to pay an additional fee in order to process the payment faster using InstantSend. Graft transaction is always approved in real time, and such approval does not require any additional fee. A small symbolic flat fee is paid by the merchant (similar to the credit card fee in the “real world” but significantly lower), which enables an an adoption of Graft for micropayments. Like in the world of traditional payments with credit and debit cards, the buyer (sender) does not care about the fee rate or complexity of the fee structure, which allows much higher conversion rates and better buying experience. Dash has another optional feature called PrivateSend which also requires additional configuration efforts and extra fees from the sender (buyer). Unlike Dash, which is based on Bitcoin code, Graft is based on CryptoNote protocol and Monero code, which provides incomparably higher level of privacy, untraceability, and unlinkability of transactions, right “out of the box”, without any additional actions or fees required from either buyer or merchant. Thus, each payment on Graft network is “visible” only to the buyer and merchant involved in this particular payment, just like in the real world of credit card payments, or in fact even better as there is no central authority in between. Unlike Dash, which is mainly a cryptocurrency with some optional features, Graft is an open payment platform that allows merchants to accept various methods of payments such as other cryptocurrencies and credit/debit cards. Different merchant payout options in altcoins of local fiat currencies will be also available through Graft point of sale app and Graft service brokers. Graft wallet users can also instantly exchange other cryptocurrencies or fiat currencies as part of the payment transaction.Graft payment processing flows and transaction types are atypical for cryptocurrencies but very usual for the brick-and-mortar and ecommerce merchants; those flows have been designed to allow an easier adoption by the mainstream merchants and consumers, without the need for any centralized intermediaries (payment processors) which defeat the basic principle of cryptocurrencies – decentralization. Unlike other cryptocurrencies that provide a single wallet app, which is typically used for both sending and receiving payments, Graft separates those functions, just like in the “real world”, between buyer’s wallet app and merchant’s point of sale app. So the users with different interests will never be confused by the “opposite” features they never use, such as top up in the wallet or payout in the point of sale. And finally, the network of Dash masternodes is based on Proof of Stake, while Dash miners still use Proof of Work. The owner of each masternode is required to pledge 1000 coins (~ $200,000) in order to be able to perform InstantSend or PrivateSend. Unlike Dash, all Graft network nodes are both instant authorizers and miners, and so they earn their right to issue real time payment approvals by successfully mining blocks. Thus, both real time authorization and mining are enabled by Proof of Work, which makes the whole system more fair and secure.